Table of Contents

The U.S. Market Analysis for the Paint and Coatings Industry, 2023-2028, written by ChemQuest in partnership with the American Coatings Association, will be released in March of this year. The previous industry analysis and forecast for the period 2019-2024 was published on March 1, 2020. We all can remember how the world — and our industry — changed just a few weeks later due to the onset of the COVID-19 pandemic and subsequent economic, manufacturing, and supply chain issues.

In contrast to previous market analyses, which had served as trusted five-year forecasts, the 2019-2024 report became a benchmark of our industry as it existed prior to the pandemic. With all previous expectations knocked off course, the ACA and ChemQuest expedited the publication of the next iteration of this important report, providing a comprehensive and detailed view of today’s domestic market and future direction of the industry, technology, and competitive landscape for the myriad segments covered.

Uniquely, the U.S. Market Analysis also incorporates input from ChemQuest interviews with industry experts (both members and non-members of the ACA). The insights from these leaders provide a solid base for analyzing the impact of trends and drivers in major market segments. A main theme of these interviews was reflected in a recent ACA committee meeting: “The story of the past four years is understanding growth in value vs. growth in volume.”[1]

Operating profitably amid economic and geopolitical challenges and severe supply chain pressures requires broad insight. With informed analysis and five-year projections for sector and segment performance, this study identifies key market opportunities and growth drivers so purchasers can gain a competitive advantage.

Reviewing 2018-2023 Highlights

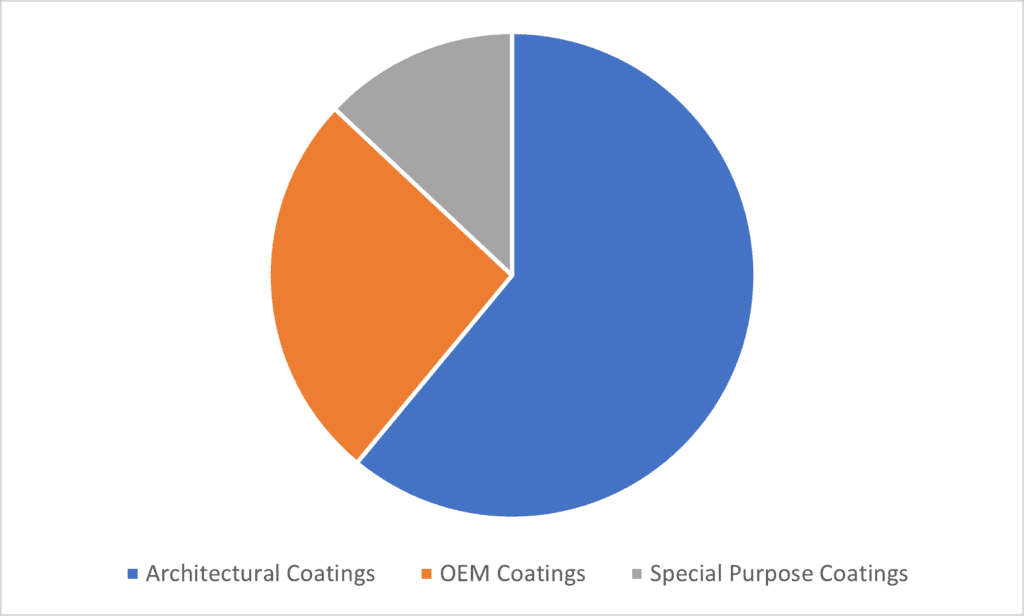

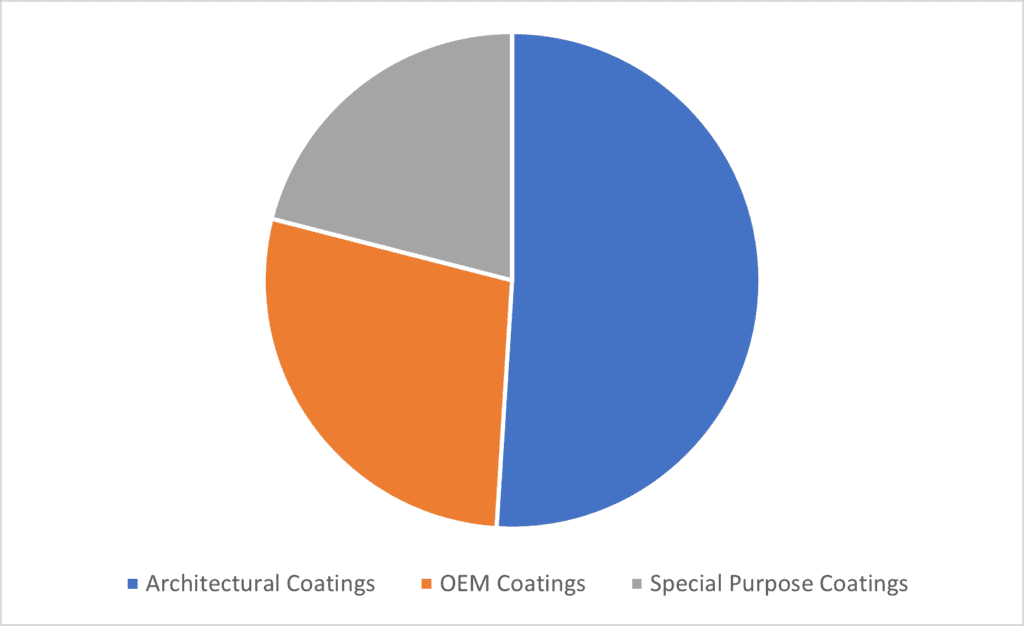

As of the preparation of this article, ChemQuest estimates the total U.S. 2023 coatings market to be 1.34 billion gallons valued at $34.1 billion. The overall coatings market is expected to be down 0.7% in volume but up 5.7% in value for the year, as producers work to hold onto and increase margins. The U.S. Market Analysis report provides information organized in three main sectors: Architectural, OEM, and Special Purpose.

(Source: The ChemQuest Group, Inc.)

(Source: The ChemQuest Group, Inc.)

Architectural Coatings

The Architectural segment is further detailed in three subsegments in the report: Floor Coatings, Wall Coatings, and Building Envelope Coatings. Together, Architectural is the single largest coatings category in the U.S. market, holding more of a share in terms of volume than in value. This implies that these types of paints do not carry the highest margin, although their use is extensive.

Architectural Coatings sales are highly correlated with the health of the housing and construction markets and follow leading economic indicators such as GDP and mortgage and inflation rates. The report’s in-depth review of this market includes a discussion of Architectural Coatings dynamics, economic and trade influences, an overview of retail channels, and technology in use and in development, along with five-year forecasts.

OEM Coatings

OEM Coatings segments include factory-applied transportation coatings; machinery and equipment finishes; metal container and closure finishes; non-wood furniture, fixture, and business equipment finishes; paper, paperboard, film, and foil coatings; rail rolling stock coatings; wood and composition board flat-stock coatings; and wood furniture, cabinet, and fixture finishes.

Automotive OEM continues to lead this industry segment by volume; metal container and closure finishes follows closely. Future growth of automotive OEM is entirely dependent on the industry’s health (automaker profits, employment concerns) and production rates of new vehicles (gas-powered and EV) produced in the U.S. This industry was adversely affected during the pandemic, as imports of needed parts and materials came to a near standstill.

U.S. consumer spending and inflation rates tie directly into the growth or decline of metal container and closure finishes, along with changing consumer habits like interest in cradle-to-grave (and potentially cradle-to-cradle) technologies. In fact, all aspects of the OEM Coatings segment rely on consumer spending and inflation as important economic indicators.

Special Purpose Coatings

Aerosol paint, automotive refinish, marine coatings, protective (industrial maintenance) coatings, and traffic marking paint are categorized as Special Purpose Coatings in the U.S. Market Analysis. Both volume and value continued to expand in 2023.

Market factors driving growth in these segments include a rebound in automotive refinish coatings, with more drivers back on the road after COVID and an increase in sales of used vehicles due to supply chain issues, as well as vehicle maintenance due to accidents or otherwise. Automotive refinish OEM brings the highest value to this market, followed by protective coatings. An expected headwind of infrastructure spending began to propel growth in 2023 and is expected to continue throughout the report period.

Exploring Future Technologies and Opportunities

During and immediately following COVID, the need for a new range of materials incorporating anti-viral and antimicrobial additives shot to the forefront of R&D efforts, propelled in part by government funding. The onset of a heightened need for innovation in an otherwise slow-to-react industry became paramount and challenging, especially for R&D teams who could not return to their workplaces as normal.

Also heightened over the past four years has been the need for increasing industry’s responsibility to leave our planet in survivable conditions for future generations. The term ESG (Environmental, Social and Governance) was barely recognized at the onset of the pandemic and is now discussed in nearly all corporate environments and reported in many. According to EcoVadis, a leading sustainability reporting platform, sustainability goals have moved from “aspirational to inevitable” and are now based on Science Based Target initiatives (SBTis).[2]

Building off this momentum, one of the most interesting chapters in the upcoming U.S. Market Analysis focuses on New Technology Developments and Market Opportunities. The divergence from performance-related to societal-based trends is noteworthy. While the trends noted in the previous U.S. Market Analysis included sustainability, regulatory, corrosion, durability, multifunctional, color, and application, the upcoming report shifts to global health, climate change, sustainability, mobility, and digitalization — all part of a broader viewpoint termed Global Megatrends.

Whereas the previous edition looked at each trend independently and in relation to its performance capabilities, the new edition reflects on the synergism between the identified drivers. For example, one would be hard-pressed to consider climate change, sustainability, and mobility without reflecting on how each affects the potential to reduce global warming.

After all, as the chapter states, “Warmer environmental temperatures negatively affect the application, performance, and durability of paints and coatings. New technologies are needed to adjust to these conditions.”[3]

Adapting to Change

As we enter 2024, operations in the U.S. paint and coating industry have returned to normal, though many things about the way paint and coatings are used have changed. An industry that has been considered stagnant and not known for innovation is now facing the need to change, brought on by consumer demands, regulatory pressures, environmental conditions, and materials innovations.

For more information, reach out to the author at efabrams@chemquest.com.

References

1. Gordon, Lynda, “Demand Forecast for the Coatings Industry Estimates through 2025,” ACA committee presentation, Washington, D.C., November 7, 2023.

2. Quincy, Annette, “Introduction to EcoVadis,” ACA committee presentation, Washington, D.C. November 8, 2023.

3. U.S. Market Analysis for the Paint and Coatings Industry, 2023-2028, American Coatings Association, expected publication March 2024, www.paint.org/usma.

Read in PPCJ.