M&A Advisory Services

Bringing Years of Experience, Insight, and Thought Leadership to Buy-Side or Sell-Side M&A Activities

What knowledge is needed to achieve a successful Buy-Side transaction?

Have you developed an investment thesis with fully defined scope that will allow you to understand viability and successfully execute and close a transaction?

Does your M&A team have the needed proficiencies for valuation, synergies, and growth prospects?

Do you have a partner to guide you through Due Diligence?

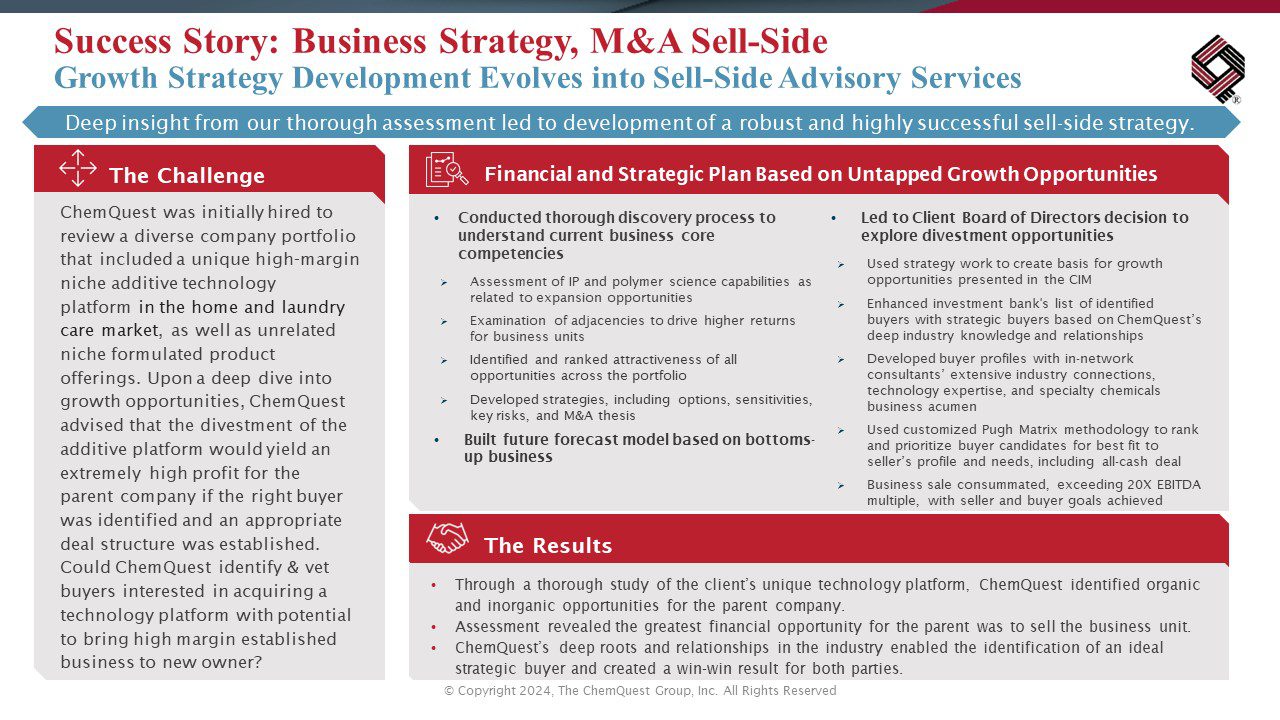

What knowledge is needed to achieve a successful Sell-Side transaction?

Do you have access to a full suite of services to multiply EBITDA?

Have you defined the potential investor suite who will have interest in your company, market, and industry?

Have you performed a Business Growth Assessment that fully examines the potential of your company if funded and managed by new ownership?

Our M&A Process

It starts with a conversation to understand whether your interest is in a Buy or Sell side transaction, protected by a Non-Disclosure Agreement, and leads to a personalized proposal to meet the objectives we jointly identify. Our work product includes:

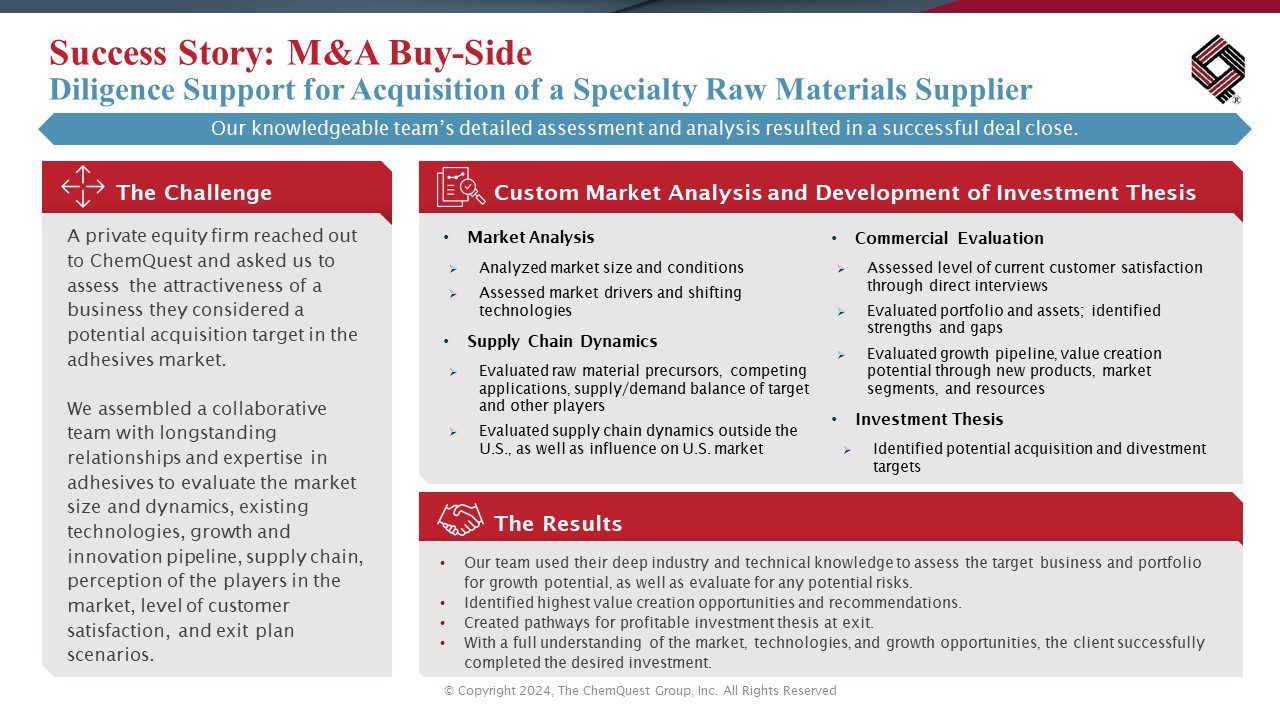

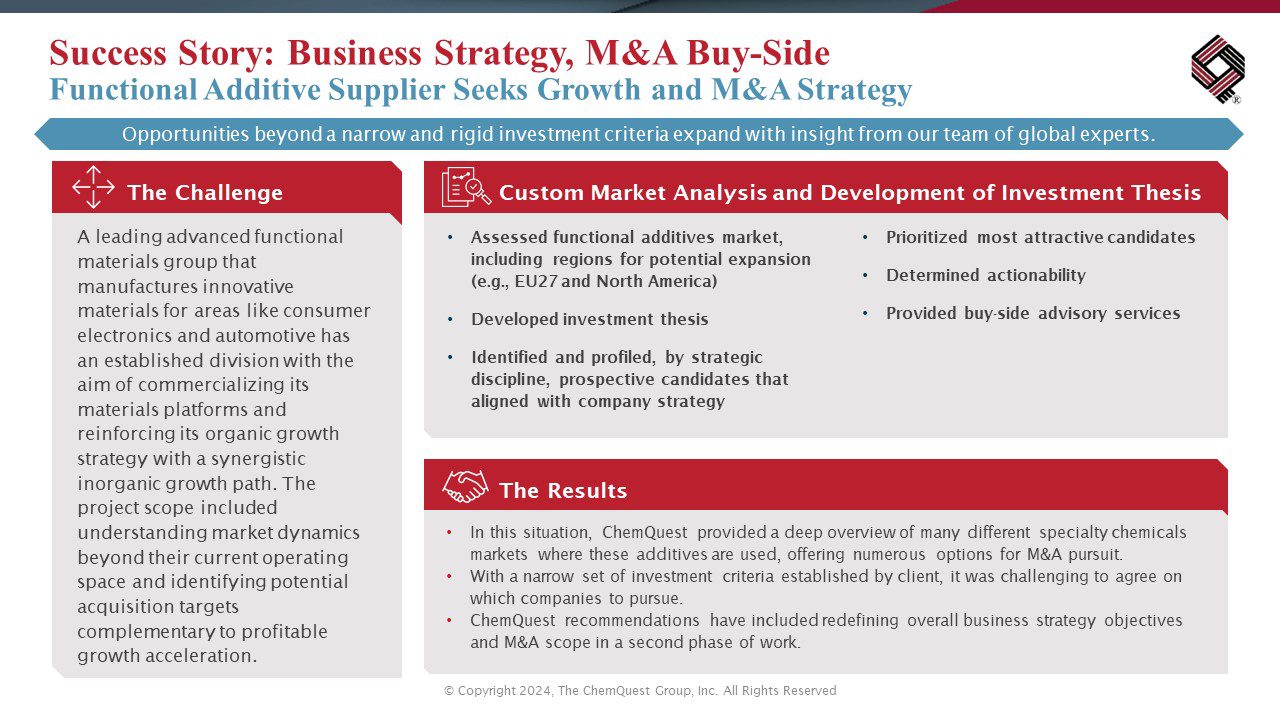

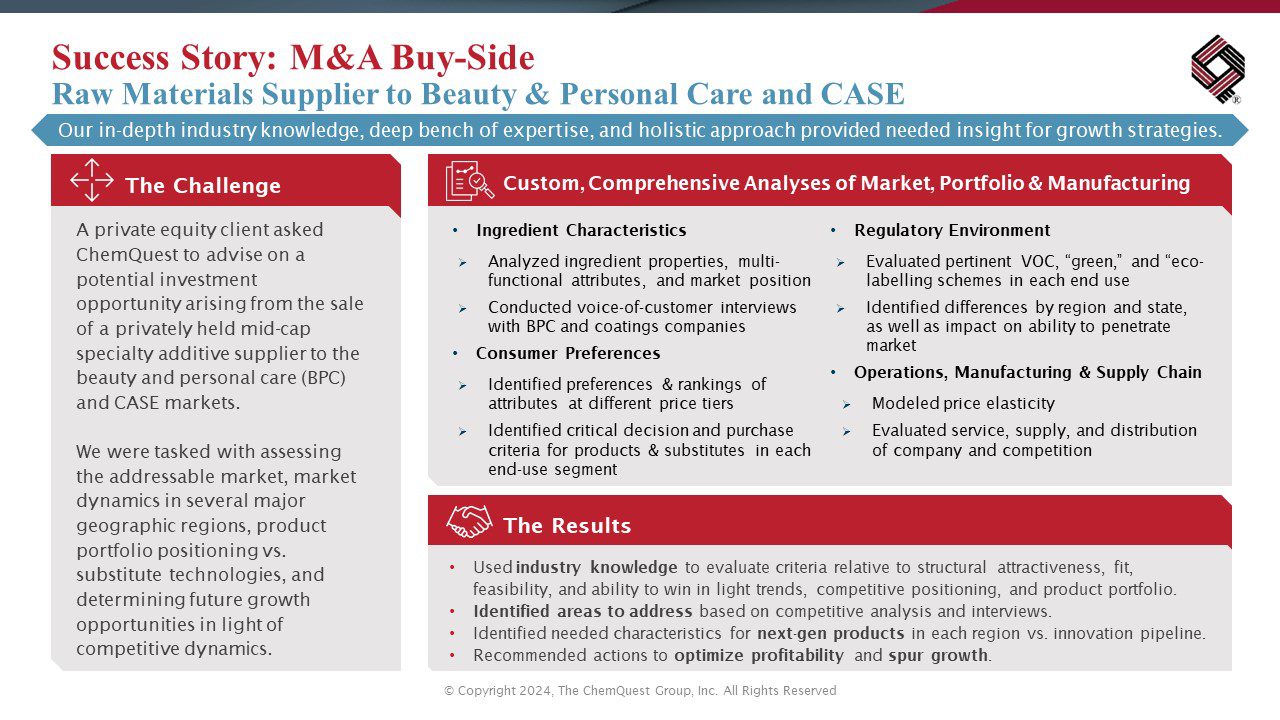

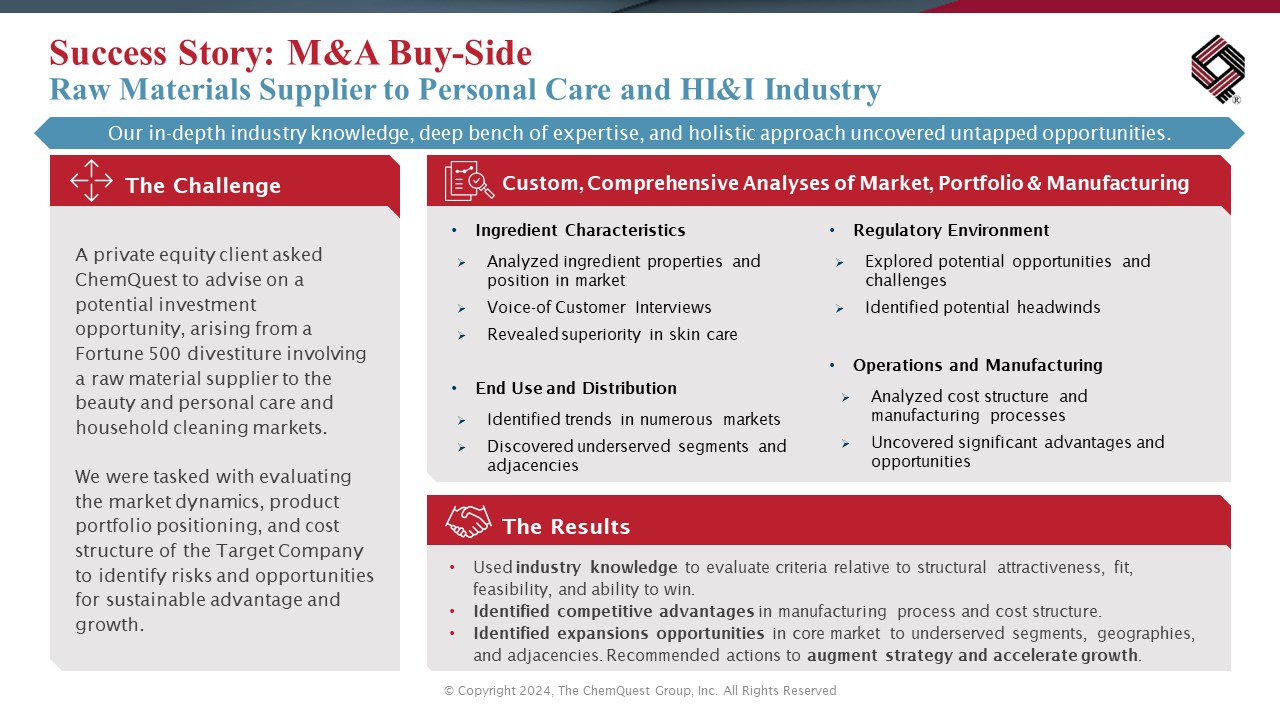

Buy-side Strategy

Sell-side Strategy

M&A Success Stories

Learn more about ChemQuest

Enter your email address to download our Introduction to ChemQuest PDF