Table of Contents

Successful business strategy relies on accurate and timely business intelligence. Traditional methods for gathering, compiling, and analyzing data from various sources are time consuming and inefficient, however, and they do not provide the ability to effectively track changes in the business cycle.

In contrast, business cycle analysis (BCA) is a vital aspect of economic analysis, guiding decision making for businesses, investors, and policymakers. While business cycles can be easy to spot in hindsight, the challenge lies in predicting changes in business cycles before they occur. With this insight, you can plan and act in sync with the changing cycle – and ahead of your competition.

BCA Basics

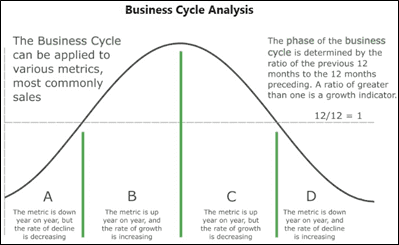

Business cycle analysis enables you to track relevant indicators within the business cycle so you can proactively assess the economy, identify trends, and capitalize on emerging opportunities.* As illustrated in Figure 1, BCA uses four phases to describe the business cycle:

- A = Advancing: The metric or indicator is down year on year, but that rate of decline is decreasing. The market is gearing up for growth.

- B = Best: The indicator is up compared to the prior year, and the rate of that growth is increasing. The market is in a growth cycle.

- C = Cautionary: The indicator is still up, but the rate of growth is decreasing. The market is slowing down.

- D = Depressionary: The indicator is down year on year, and the rate of that decline is increasing. The market is declining.

It’s important to identify multiple indicators that are relevant to your business and then track their phases to determine your path forward. Visibility into cycle changes provides an opportunity to think about and plan a change in strategy.

When you see several of your key indicators change in a similar fashion, it’s time to act. For example, if multiple indicators shift from phase D to A (indicating a period of upcoming growth), you may choose to increase inventories and marketing spend, hire top talent, and lock in long-term purchasing contracts.

*As part of ChemQuest TraQr®, a subscription-based dashboard and forecasting platform

BCA in Action

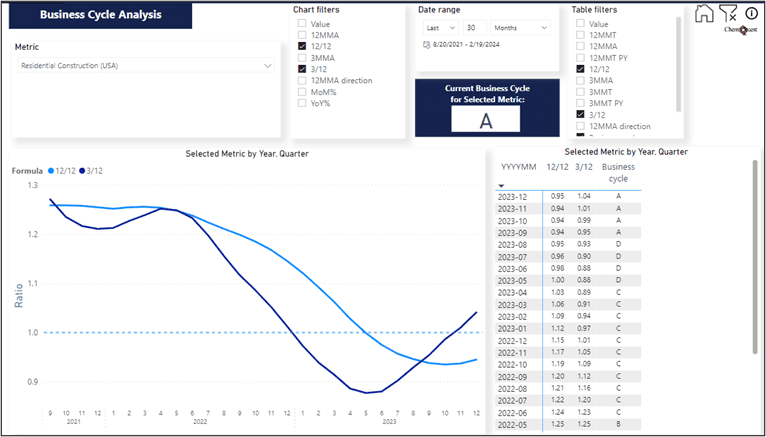

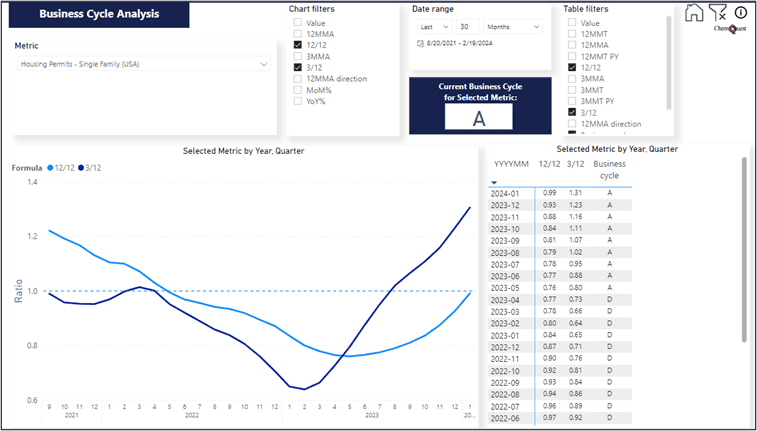

Let’s look at an example. Economic indicators such as Residential Construction and Single-Family Housing Permits are relevant for adhesive companies selling into the building and construction market. In Figures 2 and 3, we can see that Residential Construction and Single-Family Housing Permits have both been in phase A for several months (and are indeed still rising).

Tracking these indicators on a monthly basis, along with others such as Total Construction, Nonresidential Construction, and 30 Year Mortgage Rate, provides a deep understanding of economic dynamics that influence the building and construction sector. Armed with this information, you are able to adjust your business approach to align with the prevailing market conditions, navigating the ever-changing economic landscape with confidence and precision.

Forecasting Success

Traditional manual approaches to gathering and compiling business intelligence hinder your ability to forecast changes and make appropriate adjustments. Many companies don’t even have the personnel available to perform market research. In addition, data noise can be confusing and lead to conflicting perceptions of the market’s reality. As a result, you’re operating with an incomplete picture of industry dynamics.

Leveraging sophisticated market intelligence tools like business cycle analysis can enhance the efficacy of your data-driven decision-making process, facilitating the attainment of your strategic objectives. By harnessing the power of visualizing market trends through BCA and forecasting crucial industry indicators, you gain a pivotal piece of the puzzle that sets you apart from your competitors.

This formidable advantage empowers your company to stay ahead of the curve, positioning it for sustainable success in the long run. The ability to unlock invaluable insights and anticipate market shifts equips you with the foresight necessary to make informed and impactful business decisions. By capitalizing on this depth of understanding, you can navigate the intricacies of the market landscape with confidence, maximizing opportunities and achieving your organizational goals.

For more information, email the author at rgibson@chemquest.com.

Read in ASI.

Watch our Webinar

Harnessing the power of business cycle analysis