Table of Contents

Economic signs are improving in the U.S., with GDP growth in the 2023 fourth quarter reaching 3.3% (annualized rate). Jerome Powell, chairman of the U.S. Federal Reserve, has indicated that the current interest rate increase cycle has come to an end. In fact, after several better-than-anticipated inflation reports, the Fed is expected to cut interest rates this year, though the extent and timing of these actions remains uncertain.

High interest rates – coupled with low EBITDA multiples, recession fears, etc. – put a damper on M&A transactions in 2023. Many companies simply chose to wait for better conditions. This year, we expect that lower interest rates will help spur increased M&A activity.

Another factor driving an M&A rebound is the significant amount of money that has been raised and is just sitting on the sidelines. Private equity firms raised a lot of cash in 2021 and 2022, for example, and they haven’t been able to put it to use. Combined with declining interest rates and other positive economic trends, this sets the stage for an active 2024.

Evolving M&A Strategy in 2024

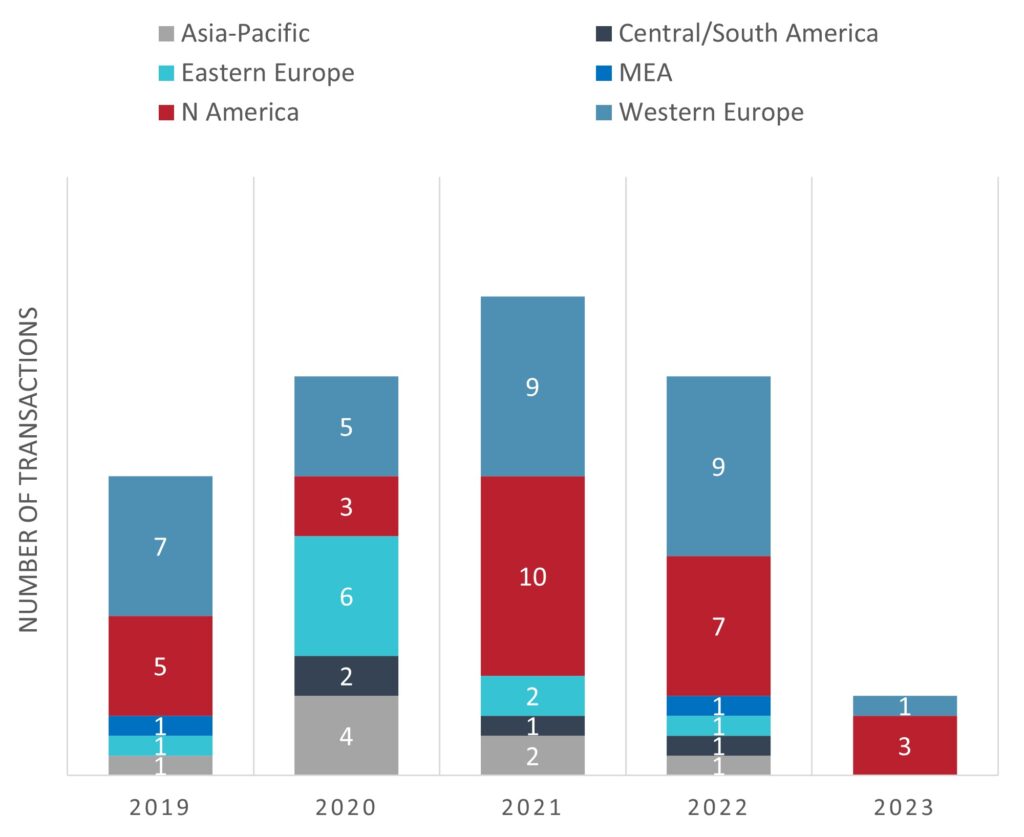

While we anticipate that activity overall will rise, M&A strategy differs depending on company size. Despite the economic uncertainty of the past several years, we still saw large-scale acquisitions by sizeable public and global multinational coatings companies (see Figure 1).

Lower multiples do not tend to deter these big transactions as much as smaller deals. In the overall scheme of things, it is often not worthwhile for huge global conglomerates to dither over a multiple of 10x vs. 11x EBITDA.

These large organizations are refining their M&A strategy in 2024 by increasingly looking to realign their portfolios. They are putting a microscope to their businesses, focusing on strategic assets, and deciding what non-strategic elements should be sold. After these divestitures are complete, the companies will be in a position to then use that cash to make more strategic acquisitions in the future.

In contrast, small- and medium-sized enterprises (SMEs) generally have had a much more difficult time in terms of M&A opportunities. They have had to consider not only the high interest rates, but the larger relative effect of lower multiples. The difference between 7x and 8x EBITDA could translate to several million dollars, potentially a much more significant impact for companies in this size range compared to the large multinationals.

Looking into 2024, SMEs are keeping a close eye on the economy and hoping that their business is able to demonstrate growth. For those that see improvements to the point of being in a position to sell, the latter part of 2024 is likely going to be the timeframe when they begin to take action.

Enhancing the Potential for a Successful M&A Transaction

While a full discussion of M&A strategy and best practices is beyond the scope of this column, I would like to share a few key concepts. On the sell side, particularly for SMEs, improving your company’s bottom line is vital; every dollar of savings results in a multiplier effect for the enterprise value.

Numerous strategies can also help optimize the strategic value of the business to, for example, uncover target growth markets, demonstrate the total addressable market, and identify industry trends and customer dynamics. By fully understanding your company’s existing technologies, technical capabilities, and pipelines, you can better focus on your ideal attractive markets, as well as the best strategy for new product development and innovation.

On the buy side, it is essential to have a fully developed business strategy. That information directly informs the acquisition strategy, the goal of which is to the plug the gaps in your strategic roadmap. For example, your company may be struggling with limitations in expanding its regional focus or an inability to enhance technologies. Only when you’ve identified the gaps and an M&A strategy is in place will your investment thesis be able to effectively detail the types of attractive acquisition candidates and how they would fill the gaps were they to be acquired.

Partnering for Profitable Growth

Whether you are looking to buy or sell as 2024 progresses, the most important thing to keep in mind is that patience and preparation are key. These are complex undertakings that require significant amounts of time and effort to achieve the best possible deal.

As a result, M&A strategy and planning can be a drain on already stretched internal resources. Many companies have found success navigating the process by partnering with a third-party firm, particularly one with extensive specialty chemicals expertise such as ChemQuest. Collaborative teams of subject matter experts with decades of experience across the value chain work synergistically and hand-in-hand as strategic thought partners alongside companies’ internal M&A personnel, interfacing with decision makers and CEOs to advise them on strategy, valuation, potential synergies, market comps, and so on. In addition, the team conducts due diligence on all aspects – from manufacturing and technology to market and commercial issues – and shepherds the process all the way to a successful closing.

With positive economic trends, readily available funds, and lower interest rates on the horizon, we are optimistic that 2024 will bring a rebound in M&A activity. If you have been on the fence about undertaking an acquisition or divestiture, now could be your time to act.

To learn more, email the author at dmurad@chemquest.com.

Reference

1. “U.S. Market Analysis for the Paint & Coatings Industry (2023-2028),” American Coatings Association, March 2024, www.paint.org/usma.

Read in PPCJ.