Table of Contents

Over the years, powder coatings have entrenched themselves as an important technology within factory-applied coatings and the coatings industry as a whole. Powder coatings continue to grow above market rate at the expense of solvent-based coatings due to their high performance and favorable environmental profile. As the coatings industry appears to have mostly recovered from the COVID-19 pandemic and resulting supply chain issues, powder coatings are positioned for strong growth — with innovation driving broader adoption into existing and new market segments.

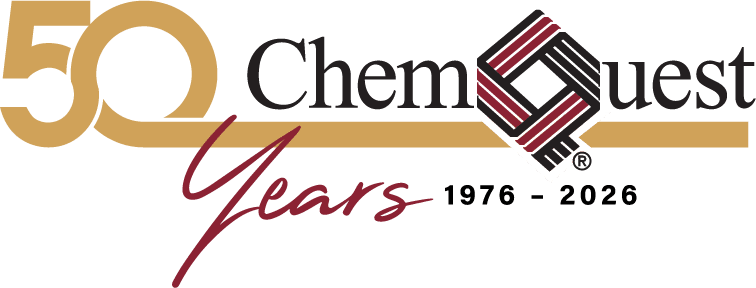

With an estimated global market value of $11.2 billion in 2024, powder coatings remain an important technology within the coatings industry. To put this in perspective, powder coatings make up 16% of the global industrial OEM coatings market by value (see Figure 1). This is particularly significant when you consider that powder coatings are limited to parts made with materials that can withstand the elevated temperatures required during the curing cycle.

(Source: The ChemQuest Group, Inc.)

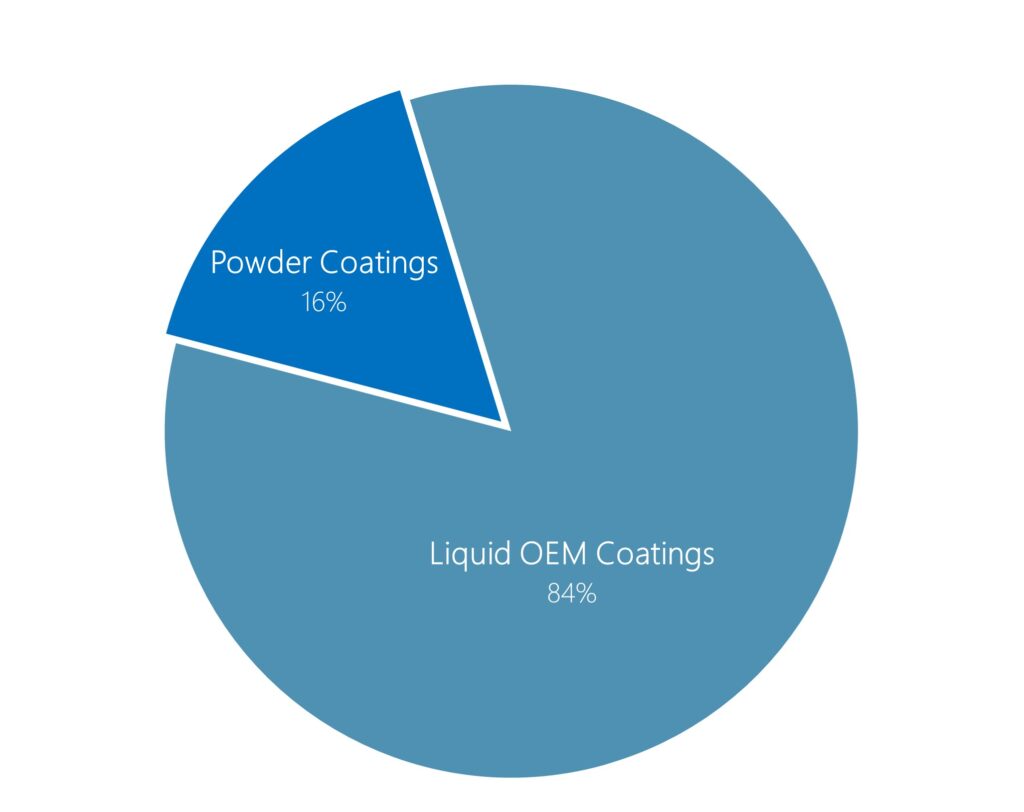

As is typically the case with coatings, the Asia-Pacific region dominates the powder coating segment with a 51% market share in terms of value, followed by Europe and North America (each at approximately 20%). The rest of the world makes up a smaller portion of the share (see Figure 2).

(Source: The ChemQuest Group, Inc.)

Major End-Use Segments

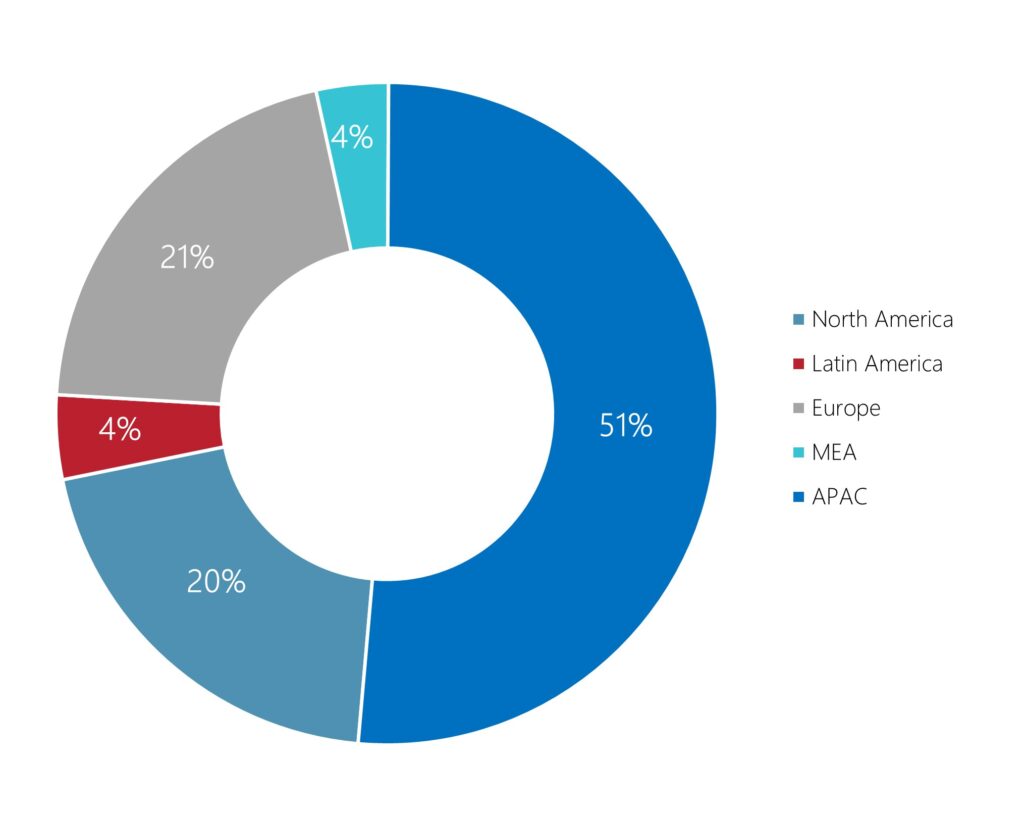

Owing to their excellent balance of cost, performance, and favorable environmental profile, powder coatings serve a wide range of market segments. As shown in Figure 3, the general metals segment dominates volume, as it is essentially a “catch-all” category for any metal parts that do not fit neatly into any of the more defined segments.

(Source: The ChemQuest Group, Inc.)

Among those more defined segments, transportation remains the largest, accounting for about 17% of the market. Powder coatings are used to coat a wide variety of automotive parts, including aluminum wheels, vehicle trim, underbody parts, and accessories such as running boards, roof racks, and tonneau covers. The transportation segment also includes components outside of automotive, such as bicycle frames.

Functional coatings, which are the next-largest segment, make up approximately 10% of the powder coating market and include the use of fusion-bonded epoxies (FBEs) for pipeline and rebar applications. Appliance coatings remain a large segment, commanding a 9% share of the market, with the remaining segments sharing the rest of the volume.

Growth Drivers

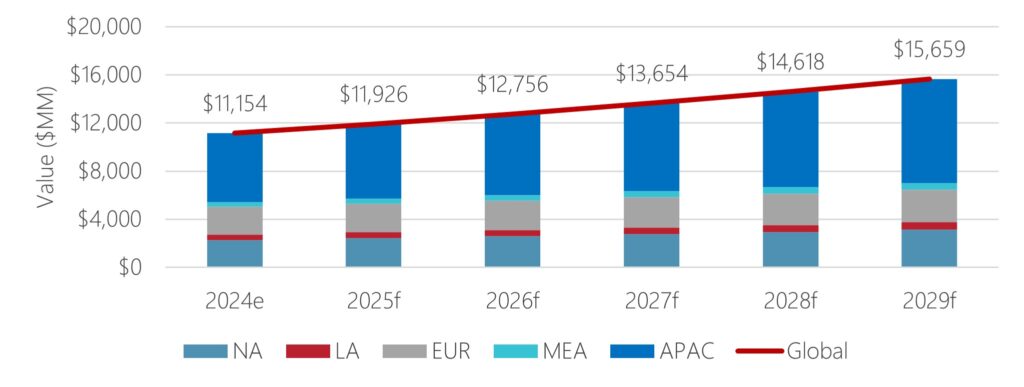

While the past five years represented a period of low growth for coatings in general, with powder growth being limited to a value CAGR of 1% and slightly negative for volume, the next five years show strong potential. The earlier period was heavily impacted by the COVID-19 pandemic and associated supply chain disruptions. Additionally, volume growth in recent years has been negatively influenced by the ability to coat parts with lower film build. However, with the global economy looking more favorable over the coming years, powder coatings by value are forecasted to grow at a 7% CAGR to 2029 (see Figure 4).

(Source: The ChemQuest Group, Inc.)

While coatings growth tends to follow global economic trends, a few factors suggest powder coatings will continue to outpace the market. In regions where the powder coating market is not fully mature — essentially, all regions outside of Western Europe — powder continues to gain share at the expense of solvent-based coatings. Even in regions where powder coatings are approaching maturity, market segments remain that are not utilizing powder coatings to their full capacity.

An example of this trend is architectural coatings in the U.S., where liquid coatings still retain a sizable share of the market. However, as powder coating aesthetics continue to improve with smoother finishes, broader color and gloss ranges, and improved metallics, it becomes increasingly difficult to imagine the value chain not shifting toward this more environmentally favorable option.

Another driver for powder coating growth is the ability to coat heat-sensitive substrates. This has been a topic of discussion for decades, but more markets are becoming accessible as powder coatings continue to take steps forward in lowering cure temperatures. The opportunities are expanding beyond the somewhat traditional, lower end applications like medium-density fiberboard for office furniture — the ability to coat composites and other lightweight materials is becoming increasingly important in segments such as agricultural, construction, and earthmoving equipment (ACE), as well as automotive. A lower cure temperature also creates opportunities for powder coatings to be used on high-metal-mass substrates and mixed-material parts, such as hydraulic components that contain heat-sensitive gaskets and other materials.

Powder coating manufacturers have also adapted to market trends by incorporating improved functionalities into their products. Since the COVID-19 pandemic, the demand for antimicrobial coatings has grown significantly, leading suppliers to develop and market their products for use in high-traffic areas such as playgrounds and fitness centers, in addition to the traditional areas of healthcare and food processing facilities.

Manufacturers are also finding success in targeting electric vehicles (EVs) by developing powder coatings with high dielectric strength and thermal insulation for use on battery packs, electric motors, busbars, and other electronic components. As EVs continue to grow at a high market rate, powder coating manufacturers are entrenching themselves in this space by making iterative improvements to their products that positively impact vehicle performance and safety.

A Bright Future Ahead

While powder coatings have long been a proven technology in the coatings industry, their reach continues to grow. The strong combination of performance and favorable sustainability profile continues to make powder an attractive alternative to solvent-based coatings, and improvements in aesthetics and cure temperatures remove barriers to adoption. Advancements in technology, expansion into new segments, and an improved economy have powder coatings poised for a period of robust growth.

To learn more, reach out to the author at ecasebolt@chemquest.com.

Read in Farbe und Lack.