In partnership with the American Coatings Association (ACA), ChemQuest is delighted to announce the release of the U.S. Market Analysis for the Paint and Coatings Industry, 2023-2028. The previous industry analysis and forecast for the period 2019-2024 was released on March 1, 2020. We all can remember how the world — and our industry — changed just a few weeks later due to the COVID-19 pandemic and subsequent economic, manufacturing, and supply-chain issues.

What was intended to be a five-year forecast instead became a benchmark of our industry as it existed and had been expected to grow prior to the onset of COVID-19. To that end, ACA and ChemQuest expedited publication of the next iteration of this important report, which provides a comprehensive and detailed view of the domestic market and future direction of the industry, technology, and competitive landscape for the myriad segments covered.

An additional unique aspect of the market analysis is the incorporation of findings from interviews with key industry experts whose insights provide a solid base for analyzing the impact of trends and drivers in major market segments. Both ACA members and non-members participated in detailed discussions with members of the ChemQuest Group. A main theme of these interviews was recently mirrored during an ACA committee presentation: “The story of the past four years is understanding growth in value vs. growth in volume.”[1]

The U.S. Market Analysis for the Paint and Coatings Industry, 2023-2028 will be available for purchase to ACA members and non-members in March 2024 through the ACA website. Notably, the study will be available to purchase as both a single-use and a corporate license, and ACA members receive special pricing.

Operating profitably amid economic and geopolitical challenges and severe supply-chain pressures requires broad insight. With informed analysis and five-year projections for sector and segment performance, this market analysis identifies key market opportunities and growth drivers so purchasers can gain a competitive advantage.

Highlights from 2018-2023

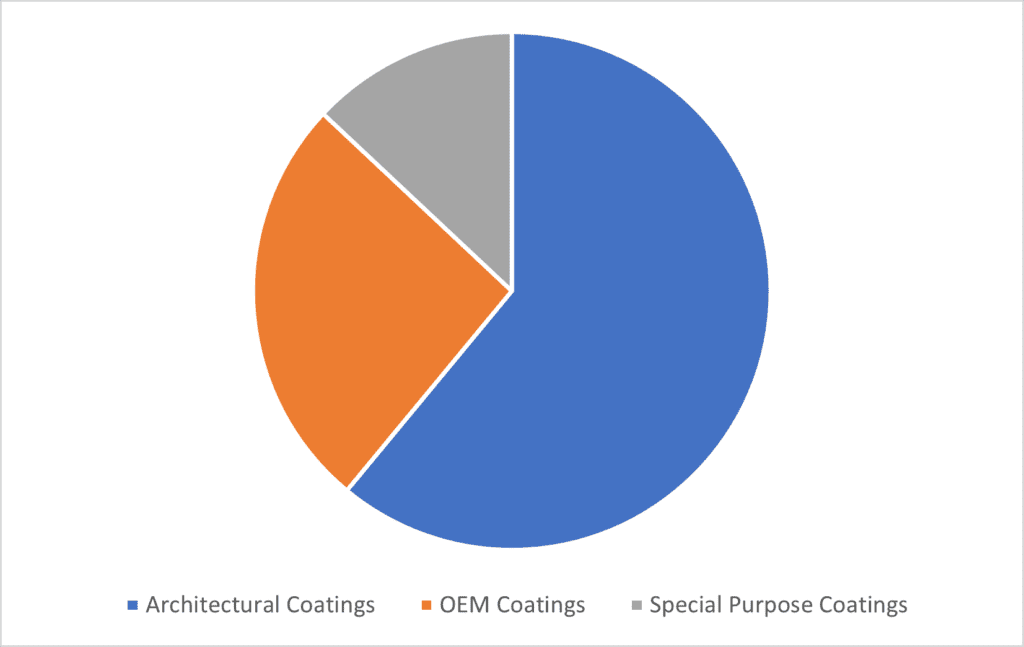

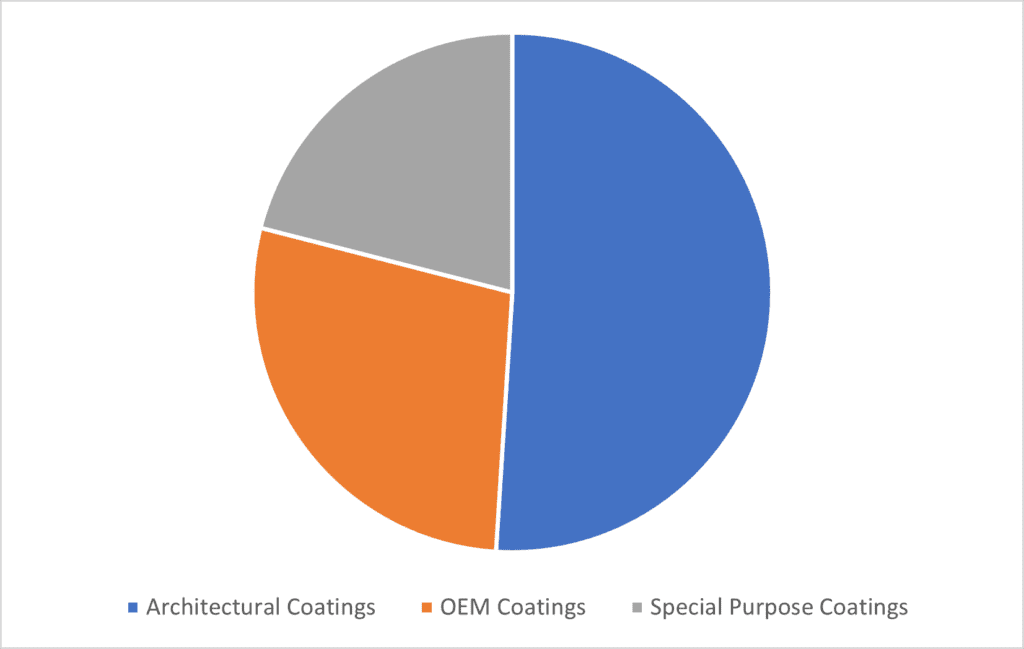

At this writing, ChemQuest estimates the total US 2023 coatings market to be 1.34 billion gallons valued at $34.1 billion. The overall coatings market is expected to be down 0.7% in volume but up 5.7% in value for the year, as producers work to maintain and increase margins. The forthcoming U.S. Market Analysis provides information organized by the coatings industry’s three main sectors: Architectural, OEM, and Special Purpose.

(Source: The ChemQuest Group, Inc.)

(Source: The ChemQuest Group, Inc.)

Architectural Coatings

The Architectural Coatings segment is further detailed in three subsegments featured in the U.S. Market Analysis: Floor Coatings, Wall Coatings, and Building Envelope Coatings. Together, Architectural is the single largest coatings category in the US market, holding more of a share in terms of volume than in value. This implies that these types of paints do not carry the highest margin, although their use is extensive.

Architectural Coatings sales are highly correlated with the health of the housing and construction markets and follow the leading economic indicators such as GDP and mortgage and inflation rates. The report’s in-depth review of this market includes a discission of Architectural Coatings dynamics, economic and trade influences, an overview of retail channels, and technology in use and in development, along with five-year forecasts.

Overall volume is expected to have increased in the 2018-2023 time period by 0.1%, with value up 6.4%. The decline in housing permits and housing starts typically manifests in lower builds, historically with a 12-month lag. With homeowners enjoying their current lower mortgage rates, housing inventory and turnovers are reaching historical lows with existing home sales on the decline.

OEM Coatings

OEM Coatings segments in the U.S. Market Analysis include factory-applied coatings, specifically: aerospace finishes; appliance finishes; automotive OEM; heavy-duty truck, bus, and RV finishes; machinery and equipment finishes; metal container and closure finishes; non-wood furniture, fixture, and business equipment finishes; paper, paperboard, film, and foil coatings; rail rolling stock coatings; wood and composition board flat-stock coatings; and wood furniture, cabinet, and fixture finishes.

ChemQuest’s 2023 estimates for OEM coatings show an overall slowing of volume (up just 2.3%), with a value increase of 6.6%. This is reflective of an easing demand for durable goods.

Automotive OEM continued to lead this industry segment by volume for the 2018-2023e time period, showing a slight decline (0.36%) from the previous five-year comparison. Metal container and closure finishes followed closely, showing a 1.9% increase in volume from the previous five-year comparison.

Future growth of automotive OEM is entirely dependent on the industry’s health (automaker profits, employment concerns) and production rates of new vehicles (gas-powered and EV) produced in the United States. The automotive industry was adversely affected during the pandemic, as imports of needed parts and materials came to a near standstill.

US consumer spending and inflation rates tie directly into the growth or decline of metal container and closure finishes, along with changing consumer habits like interest in cradle-to-grave, and potentially cradle-to-cradle, technologies. In fact, all aspects of the OEM coatings segment rely on consumer spending and inflation as important economic indicators.

Special Purpose Coatings

Aerosol paint, automotive refinish, marine coatings, protective (industrial maintenance) coatings, and traffic marking paint are categorized as Special Purpose Coatings in the U.S. Market Analysis. The products used in these markets are designed for specific use and often have added value. We estimate that both volume and value continued to expand for this segment in 2023 (2.6% and 7.1%, respectively).

Market factors driving growth in these segments for the 2018-2023e time period included a rebound in automotive refinish coatings, with more drivers back on the road after COVID, an increase in sales of used vehicles due to supply-chain issues, and vehicle maintenance due to accidents or otherwise. Although representative of only 26% of the volume of this segment, automotive refinish brought 47% of the value.

The oil and gas sector continues to drive protective coatings, which represented 32% of volume and 33% of value for Special Purpose Coatings over 2018-2023e. An expected headwind of infrastructure spending began to propel growth in 2023 and is expected to continue throughout the report period.

New Technologies and Market Opportunities

No one could have predicted the events of the past four years. The complete shutdown of manufacturing and R&D facilities, travel restrictions, work from home, a shift in the way consumers shop from in-store to online, curbside pickups, an inordinate amount of time in our individual living spaces, and a huge increase in DIY projects — and that was just the first six months.

As soon as these changes began to feel normal, we faced shipping and logistic challenges. Containers piled up in our nation’s harbors, a huge winter storm shut down operations in the US gulf region in Q1 2021, and supply-chain shortages were abundant. Hoarding of raw materials became the new normal. Price increases buoyed the value of the paint and coatings industry, and consumers and end users had no choice but to open their pocketbooks.

During this time, the need for a new range of materials incorporating anti-viral and antimicrobial additives shot to the fore of R&D efforts, propelled in part by government funding. How could we protect ourselves in our homes and in common spaces ranging from airplanes to doctors’ offices to restaurants? The onset of a heightened need for innovation in an otherwise slow-to-react industry became paramount and challenging, especially for R&D teams who could not return to their workplaces as normal.

Also heightened over the past four years has been the need for increasing industry’s responsibility to leave our planet in survivable conditions for future generations. The term ESG (Environmental, Social and Governance) was less common at the onset of the pandemic and is now discussed in nearly all corporate environments and reported in many. According to EcoVadis, a leading sustainability reporting platform, sustainability goals have moved from “aspirational to inevitable” and are now based on Science Based Target initiatives (SBTis).[2]

Building off this momentum, one of the most interesting chapters in the upcoming U.S. Market Analysis focuses on New Technology Developments and Market Opportunities. The divergence from performance-related trends to societal-based trends is noteworthy. While the trends noted in the previous iteration of the U.S. Market Analysis included sustainability, regulatory, corrosion, durability, multifunctional, color, and application, the upcoming report shifts to global health, climate change, sustainability, mobility, and digitalization — all part of a broader viewpoint termed “Global Megatrends.”

Whereas the previous market analysis looked at each trend independently and in relation to its performance capabilities, the new edition reflects on the synergies between the identified drivers. For example, one would be hard-pressed to consider climate change, sustainability, and mobility without reflecting on how each affects the potential to reduce global warming.

As the chapter states, “Warmer environmental temperatures negatively affect the application, performance, and durability of paints and coatings. New technologies are needed to adjust to these conditions.”[3]

Market Analysis Lessons Learned: Adapting to Change

As we enter 2024, operations in the paint and coatings industry have returned to normal, though many things about the way paint and coatings are used have changed. An industry that has been considered stagnant and not known for innovation is now facing the need to change brought on by consumer demands, regulatory changes, environmental conditions, and innovation in materials. ChemQuest will continue to monitor and share our insight on the US market throughout the coming year, in preparation for the Q1 2025 publication of the World Coating Council Global Market Analysis, 2024-2029 — an extensive review and forecast of the global paint and coatings industry.

For more information, please reach out to the author at efabrams@chemquest.com.

References

- Gordon, Lynda, “Demand Forecast for the Coatings Industry Estimates through 2025,” ACA committee presentation, Washington, D.C., November 7, 2023.

- Quincy, Annette, “Introduction to EcoVadis,” ACA committee presentation, Washington, D.C. November 8, 2023.

- U.S. Market Analysis for the Paint and Coatings Industry, 2023-2028, American Coatings Association, expected publication March 2024, www.paint.org/usma.

Read in CoatingsTech.