Table of Contents

The global paint and coatings industry produced an estimated 48.9 billion liters valued at $202 billion in 2024, according to the recently published Global Market Analysis for the Paint & Coatings Industry (2024-2029). Compared to the prior year, the industry grew by approximately 0.4% in volume and 2.5% in value.

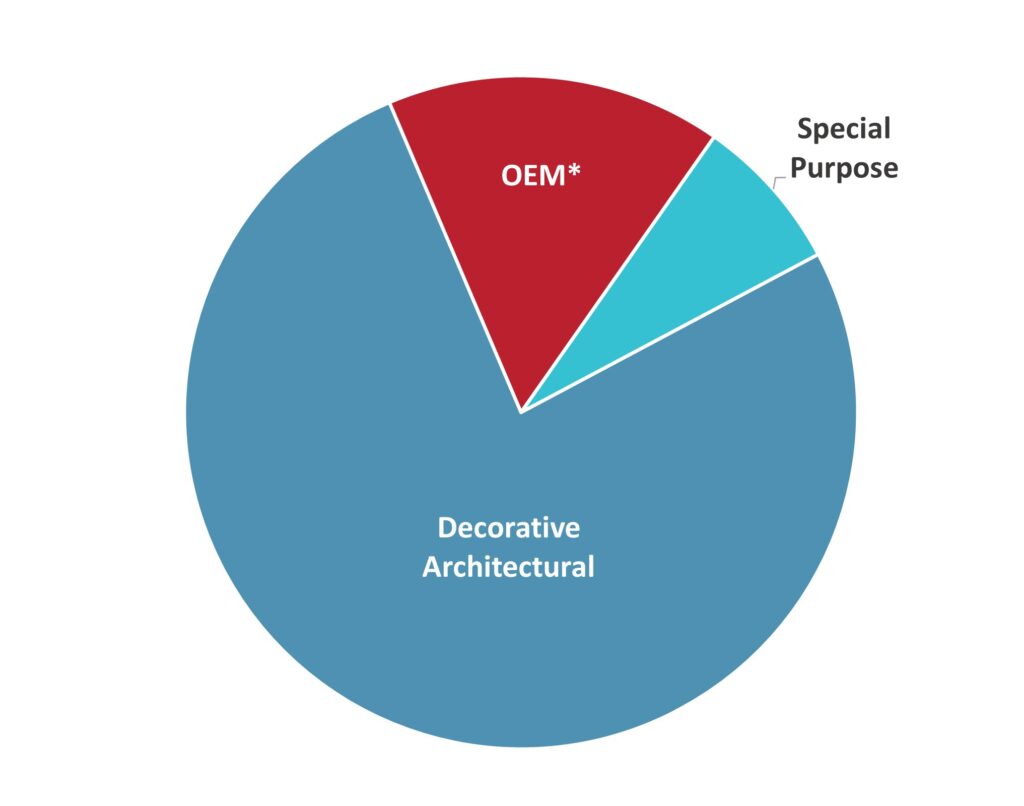

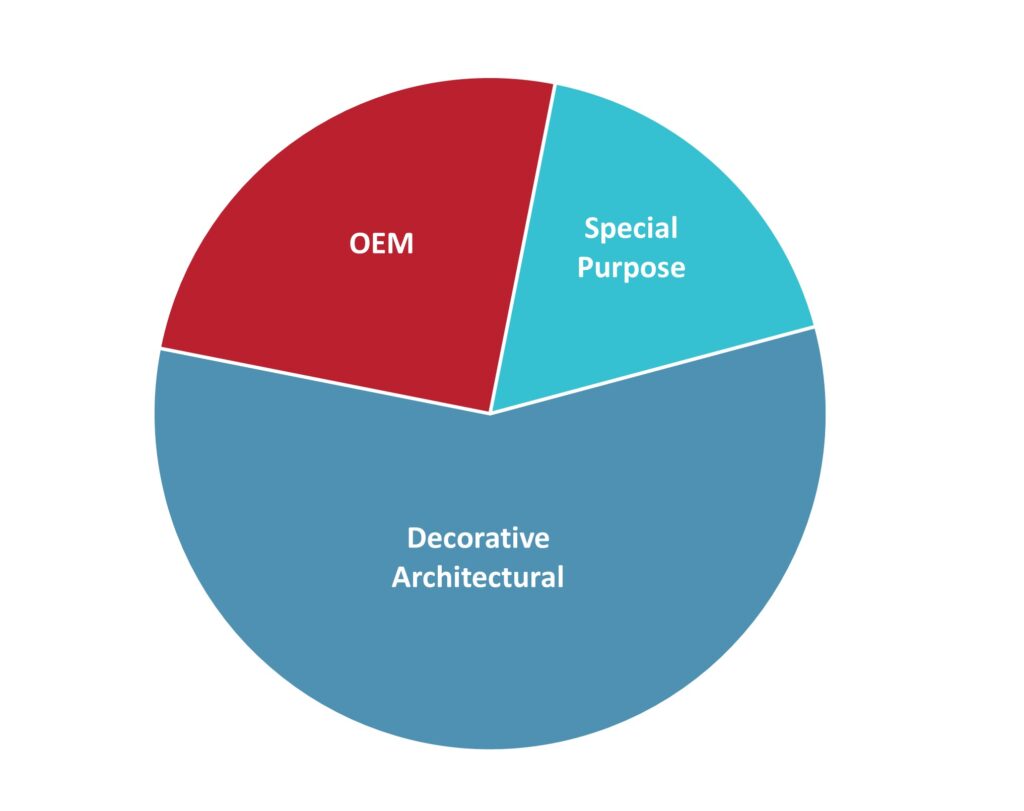

The in-depth Global Market Analysis, which was developed by ChemQuest in partnership with the World Coatings Council and the American Coatings Association, focuses on three main coatings market segments: Decorative Architectural Coatings, OEM Coatings (includes five sub-segments), and Special Purpose Coatings (three sub-segments). Additional detailed chapters provide data and analysis for five regions around the world, including Latin America. (The other regional chapters include North America, Europe, Asia Pacific, and Middle East and Africa.)

Latin America Regional Highlights

For the purposes of the Global Market Analysis, Latin America is considered to consist of countries from Central and South America, as well as Mexico in North America and the Caribbean nations. Four individual countries – Brazil, Mexico, Argentina, and Columbia – are estimated to account for over 75% of Latin American coatings demand and value.

The Latin America region represents an estimated 8.8% by volume and 7.4% by value of the global paint and coatings industry. Decorative Architectural is the largest segment in Latin America (in terms of both volume and value), as shown in Figures 1 and 2.

*Includes liquid coating volumes in MML and powder coating volumes in KT

(Source: The ChemQuest Group, Inc.)

(Source: The ChemQuest Group, Inc.)

Decorative Architectural Coatings

The Decorative Architectural Coatings segment encompasses decorative interior and exterior wall primers, paints, etc. In Latin America, the segment is estimated to have grown by 1.7% in volume and 5.2% in value from 2019-2024. Brazil and Mexico accounted for most of this growth, followed by Argentina and Columbia.

Looking forward, Decorative Architectural Coatings is expected to remain a primary market for the Latin America region, with Brazil retaining approximately 50% of the regional sales. The Global Market Analysis projects that growth through 2029 will be driven primarily by new construction to support the growing urban population and services sector. In addition, the region is likely to benefit from near-shoring initiatives by North American and European companies that are looking to shift their manufacturing away from China.

OEM Coatings

OEM Coatings in Latin America are expected to have grown 1.2% by volume and 2.7% by value in 2024 vs. 2023, according to the Global Market Analysis, as a result of receding inflationary pressures and the stabilization of export partners’ economies. Over the 2020-2023 timeframe, this sector also benefited from increasing near-shoring activities following the COVID-19 pandemic, as well as strong spending in the building and construction sector to support a booming services industry.

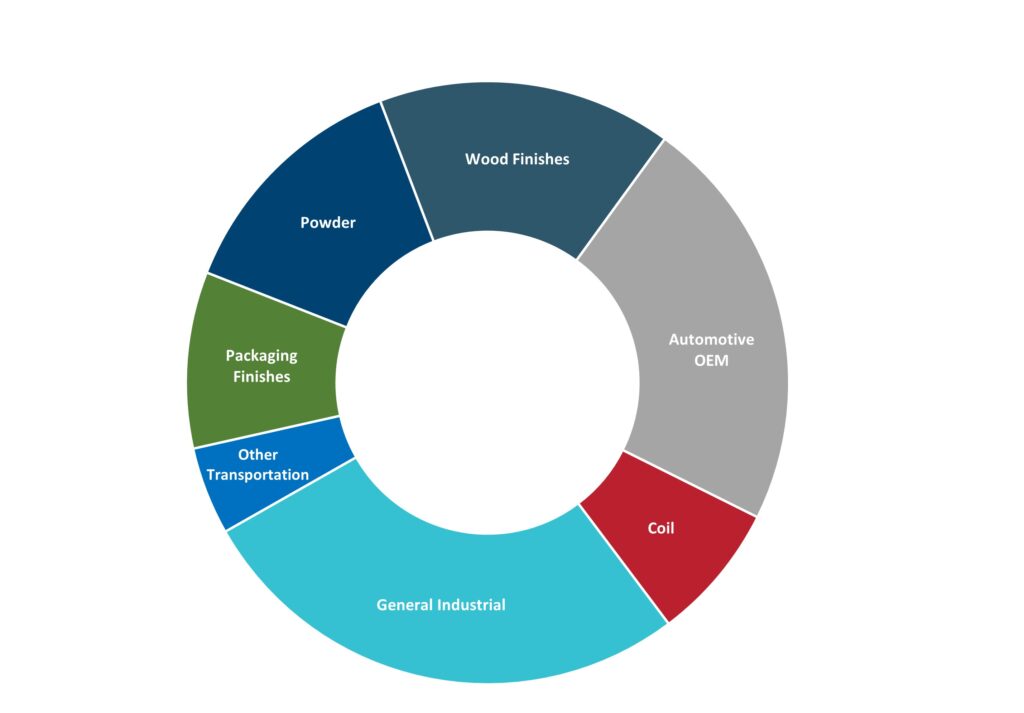

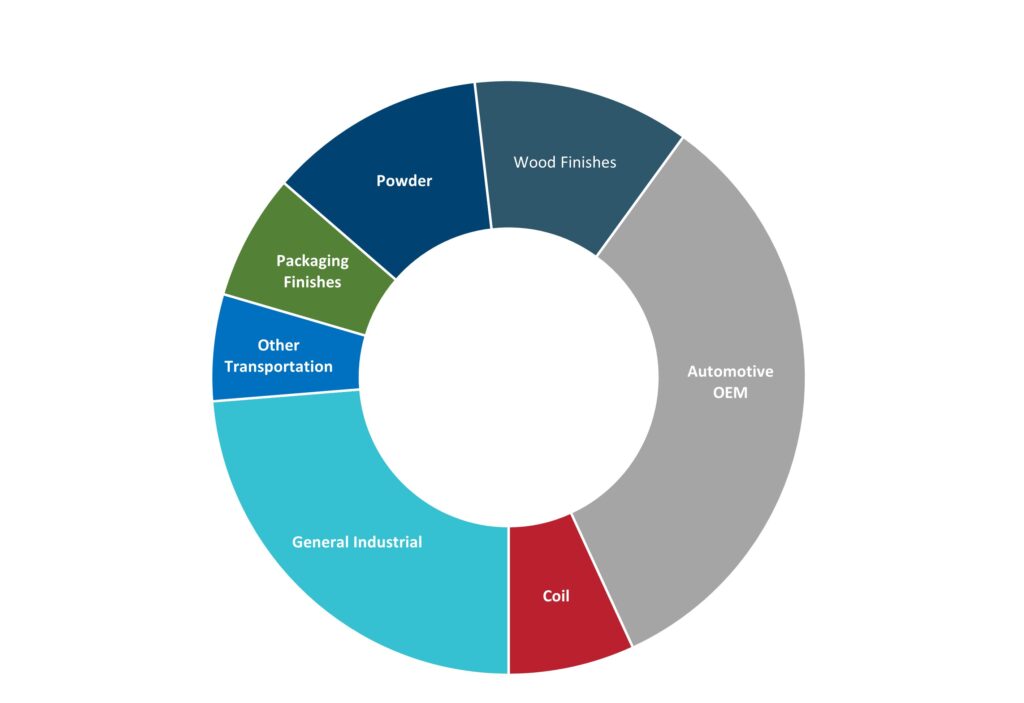

Increased appliance and parts production for export over 2021-2023 drove volumes in Powder Coatings, Coil Coatings, and Packaging Finishes to exhibit the fastest growth among OEM Coatings. The Automotive OEM Coatings sector struggled, however, due to electronic component shortages combined with depressed consumer confidence in North America and Europe. Figures 3 and 4 show estimated OEM Coatings end-use segments by volume and value, respectively, for 2024.

*Includes liquid coating volumes in MML and powder coating volumes in KT

(Source: The ChemQuest Group, Inc.)

(Source: The ChemQuest Group, Inc.)

According to the Global Market Analysis, strong growth in building and construction will drive increasing demand in Coil Coatings, Powder Coatings, and Wood Finishes in Latin America from 2024-2029. Powder Coatings and Wood Finishes, in particular, will see the strongest volume growth (CAGRs of 3.8% and 3.4%, respectively).

The automotive and general industrial (oil and gas/mining, pipe fabrication) sectors are anticipated to provide expansion opportunities for Powder Coatings over the forecast period. Beneficial properties such as affordability, high performance, environmentally friendly attributes, and energy efficiency are increasingly making powder an attractive coating option.

Special Purpose Coatings

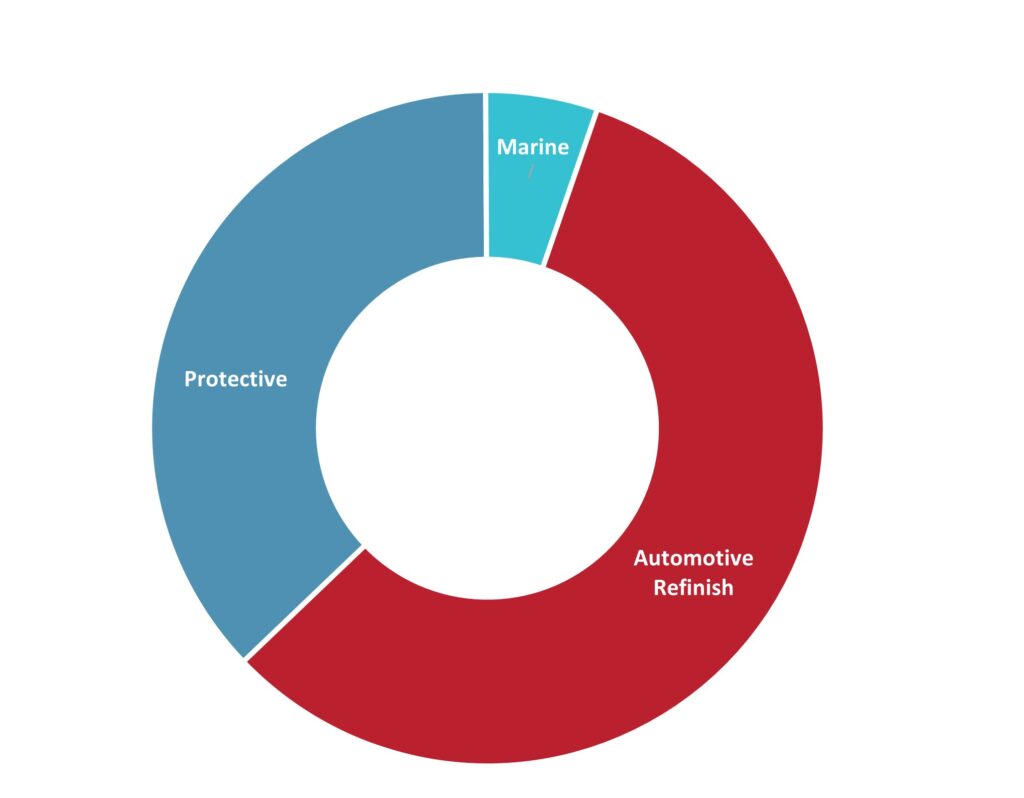

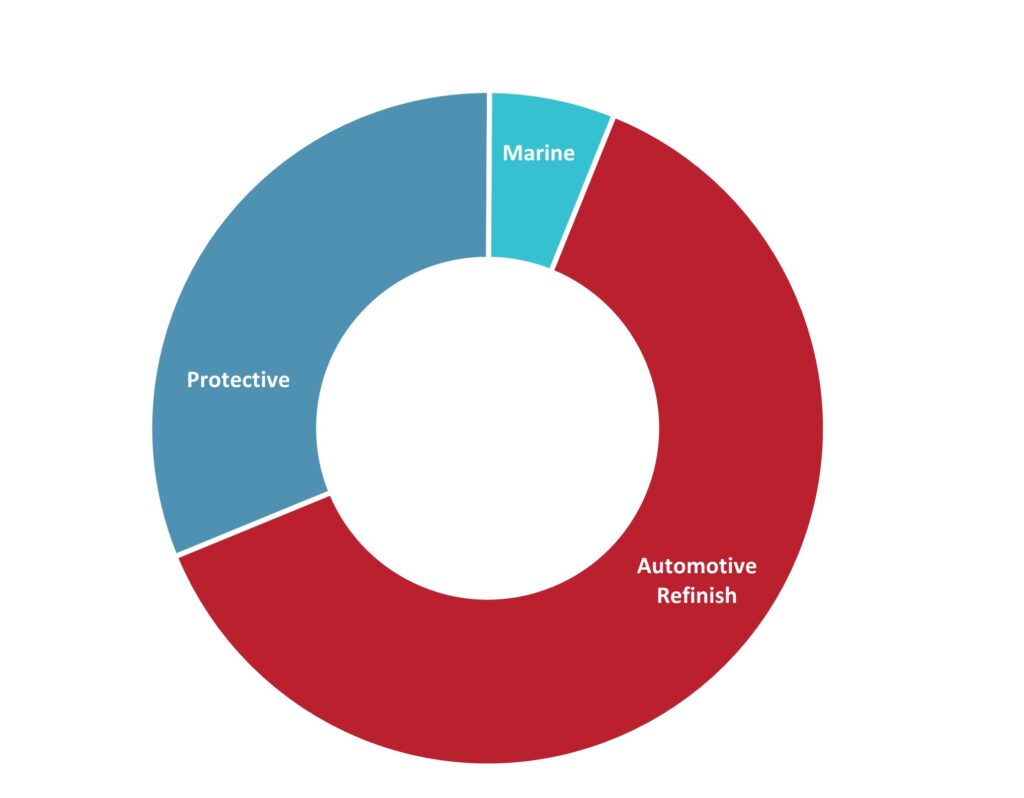

The Special Purpose Coatings segment in Latin America struggled to recover from the COVID-19 pandemic through 2023, primarily due to the resultant depressed automotive demand and lower crude oil production. As shown in Figures 5 and 6, Automotive Refinish Paint represents the largest end-use category of the Latin America Special Purpose Coatings segment in terms of both volume and value. Automotive Refinish is expected to have returned to pre-pandemic volumes by the end of 2024, pushing overall volume growth for Special Purpose Coatings to 2.1% for the year.

(Source: The ChemQuest Group, Inc.)

(Source: The ChemQuest Group, Inc.)

Though subdued through 2024, Protective Coatings demand is expected to pick up as a result of numerous public infrastructure projects in major Latin American countries, as well as the expansion of mining operations (e.g., lithium, rare earth, commodity metals). In addition, recovering consumer demand in the automotive sector is anticipated to help drive a 2.5% mid-term CAGR in Latin American Automotive Refinish Paint volume.

Technology Trends and Drivers

The Global Market Analysis highlights several technology-related trends that are impacting the paint and coatings industry in Latin America. First and foremost, low-volatile organic compound (VOC), eco-friendly coatings represent a pervasive trend across almost all sectors. Demand is being driven by the regulatory mandates of near-shoring clients from primarily North America and Europe, as well as a growing national awareness for sustainable solutions.

A shift from solventborne to waterborne (especially acrylic latex) and Powder Coatings continues to strengthen in the Latin American construction and OEM sectors. Powder coating, in particular, has seen a resurgence in Mexico in recent years, with expanding demand in the architectural, automotive, and general industrial sectors. Although the automotive OEM and refinish sectors continue to be the largest consumers of powder coatings, increasing demand for painted architectural structures and corrosion-control coating in industrial sectors, such as O&G piping fabrication, is driving growth.

Electric vehicle (EV) demand is also providing numerous opportunities for paint and coatings in Latin America. For example, Chinese OEMs like BYD, Chery, and Gotion are investing heavily in EV production in countries such as Mexico, Brazil, Argentina, and Peru. In addition, Mexico is developing plans to build its first EV manufacturing hub in Sonora, with further expansion expected over the next decade.

While EV production will increase demand for traditional automotive paints, opportunities are expected to be wide reaching. The Global Market Analysis notes related opportunities for high-performance advanced coatings systems for fire protection, corrosion and impact protection, temperature management, and electrical shielding in battery packs, power conversion components, and electric drive systems.

Regional differences in climate and construction practices shape paint and coating technologies in Latin America. For example, high-humidity regions like the Caribbean and much of Brazil require moisture-resistant paints that will not peel and blister. Arid regions in Western Latin America require UV-resistant paints, while the mountainous Andean regions require rugged coatings that can withstand temperature and pressure extremes.

What Does the Future Hold?

The paint and coatings industry in Latin America is anticipated to see above-GDP growth over the mid-term, spurred mainly by public and private sector investments in the manufacturing and service sectors. The Global Market Analysis forecasts a 3.4% increase in volume and 6.2% in value over the 2024-2029 forecast period.

Overall, the region’s industry recovered swiftly from the pandemic due to a surge in Decorative Architectural Coatings demand from real estate projects to accommodate expansion in services and increasing urbanization. The sector continues to experience robust growth. Increasing government spending on public works projects, growing global demand for mined metals, and continued near-shoring of North American and European production will be significant contributors to mid-term Special Purpose and OEM Coatings growth.

To learn more, reach out to mrodrigues@chemquest.com or visit https://chemquest.com.

Additional details regarding the Global Market Analysis are available at https://chemquest.com/library/#market-report.

Read in Spanish and Portuguese in ipcm.