Table of Contents

While the number of M&A transactions in the specialty chemicals space has normalized back to pre-pandemic levels following robust activity in 2021 and 2022, valuations in 2023 have actually increased over last year’s levels. Opportunities clearly abound for sellers that are well-positioned to deliver the best value proposition to potential buyers.

But how do you know when it’s time to sell your company (or a portion thereof)? What are the various opportunities and potential pitfalls involved in this extremely complex process? Can you expect a quick sale once you’ve made the decision?

The answer to that last question is invariably: Not likely. After all, when selling a home, it’s a rare homeowner who can expect to net a top price without first making some improvements. Indeed, savvy home sellers often turn to professionals who employ a range of approaches to identify target buyers and maximize value. Whether a simple light refresh or a more extensive remodel, the extra investment in time and resources invariably leads to a higher selling price.

Similar concepts apply when selling your company or business unit. Shortcutting preparation steps often leaves money on the table, while additional up-front work can bear significant fruit. First, however, you need explore whether divesting is the best strategy.

First Things First

In one example that illustrates what this process can entail, a company wanted to develop a growth strategy but was unsure where to focus its efforts. The company had a diverse product portfolio that included a unique high-margin additive technology platform in the home and laundry care market, along with unrelated niche formulated product offerings.

Following a thorough discovery process to understand the current business’ core competencies, a consulting team with deep experience in the specialty chemicals sector developed a bottoms-up forecast. Various stages of the process included an assessment of intellectual property (IP) and polymer science capabilities as related to expansion opportunities, an examination of adjacencies to drive higher returns for business units, the identification and ranking of all opportunities across the portfolio, and the development of various strategies (taking into consideration issues ranging from sensitivities and key risks to an M&A thesis).

Ultimately, following this deep dive into growth opportunities, the consulting team advised that the divestment of the additive platform would yield an extremely high profit for the parent company if the right buyer could be identified and an appropriate deal structure established. Steps in this added, secondary portion of the project included:

- Strategy work performed to date was used to create a basis for the growth opportunities presented in the confidential information memorandum (CIM).

- The investment bank’s list of identified buyers was enhanced with strategic buyers based on the consultants’ deep industry knowledge and relationships.

- The consulting team further developed buyer profiles using its extensive industry connections, technology expertise, and specialty chemicals business acumen.

- A customized Pugh Matrix* methodology was used to rank and prioritize buyer candidates for best fit to the seller’s profile and needs.

Though not a simple or quick process, all of this additional work paid off. The consulting team identified the ideal strategic buyer, and the business sale ultimately exceeded a 20X EBITDA multiple (all-cash and well above the industry average), enabling the company to pursue organic and inorganic opportunities to grow the remaining business.

Preparation is Key

Once you’ve made the decision to sell your company/division, you must fully identify your business goals and consider the ideal strategy going forward. The rationale behind your sale could be as simple as the need to continue to have sufficient access to capital for growth. In other cases, you may want to focus resources on specific core markets.

No matter the ultimate reason, the main goal of selling a business remains the same as selling a home—you want to obtain the most value and find the right buyer while achieving the right price and terms of sale. Equally critical are considerations of potential integration scenarios, the ability to successfully close the deal as agreed, and completion of regulatory hurdles such as antitrust and Committee on Foreign Investment in the United States (CFIUS) requirements. A deal can fall apart as a result of these factors, even after significant investment in time and money, so they need to be considered up front.

You will want to allow at least 12 months or more to prepare the business for sale, well before active marketing begins. Your internal team should interview and select experts in the form of consultants, bankers, and advisors who will have roles in coordinating all aspects of the sale and marketing materials. Look for companies to partner with that have the skills and experience in your industry to drive real value—beyond simply putting “lipstick” on your business.

Your consulting team can capture additional value through understanding the industry, characterizing the market and your company’s position in it, and developing the value proposition with the target buyer pool always top of mind. A full understanding of the potential buyer pool and their strategies was a particularly influential aspect of the previously described success story. Figure 1 details how this process unfolds from start to finish.

In parallel, assessing operations to clean up and optimize processes, identify and capture profit leaks, and explore options and showcase value in the innovation and sales pipeline are key to increasing the current earnings before interest, taxes, depreciation, and amortization (EBITDA), decreasing working capital, or influencing the sales multiple. All of these efforts result in more money for the seller at the end of the process.

Of course, your company ownership and management will most likely have their own concept of the business’ value, based on EBITDA times the expected multiple. Based on size, industry, quality of earnings, growth, and current economic/market factors, multiples can range from an average of 10.5x for a specialty chemical manufacturer to 16x for consumer packaged goods (CPG) companies.

Keep in mind that these are just averages. Buyers will adjust their offer based on their assessment of the strength of the investment thesis, projected synergies, and the extent to which the purchase enables them to meaningfully achieve their strategic goals. In fact, buyers may pass at making an offer altogether if they conclude that your business requires excessive time and money in maintenance or integration efforts and/or lacks a compelling strategic alignment.

Finding the Right Buyers

During the preparation process, your consulting team will consider the who and establish the why for each potential buyer. It is important to be thorough and quantitative about the benefits and unique synergies that will drive interest in your business and impact how much each buyer might pay to acquire it.

Synergies play an integral role in the price a buyer is willing to pay over the standard multiple. They relate to the expected improvement in financial performance of the post-close combined enterprise compared to the financial results and projections of the existing base business. Estimated synergies will be different for each potential buyer based on their assets, capabilities, and strategic direction, as well as the extent to which they are similar or complementary with your business and the ability to accelerate sales and/or reduce costs.

The consulting team will use this thorough understanding of the different players and their strategies to cast a targeted net and tailor the communications accordingly. Obvious choices for potential strategic buyers include:

- Direct competitors

- Companies looking to diversify or strengthen their portfolio or technology platforms in specific markets

- Companies looking to expand their geographic reach or manufacturing footprint or acquire enabling capabilities and platforms

- Companies seeking to forward- or back-integrate

Financial buyers represent another significant and attractive buyer pool. Private equity (PE) buyers historically have been known to pay lower prices (multiples) to sellers. However, as PE firms have built platforms based on multiple acquisitions, they are able to achieve and pay for synergies. Financial leverage can make the return on invested capital attractive to this type of buyer. PE firms can also bring additional resources to bear to further business growth, and they offer the increased autonomy of being private vs. public.

The teaser and confidential information memorandum (CIM) will likely represent the main marketing materials for your business during this process, but they do not highlight the synergies for specific buyers. The teaser is a short document that provides an overview of the business without revealing your company’s identity, while the CIM is a comprehensive “book” about your business, its finances, and assets.

Since each buyer must determine the benefits, synergies, and value for themselves, best practices for sellers often include developing a rationale for acquiring the business tailored to each buyer. Your consulting team may use these key points to highlight potential value to buyers; serious buyers also engage their own advisors to independently validate value.

To evaluate synergies, your team will also consider cost savings, sales gains, and accelerated growth rates. Cost savings may include raw material and service savings from increased purchasing power, higher value use of intermediates/byproducts, process/efficiency improvements from shared intellectual property (IP), and streamlining and/or consolidating operations and services.

Revenue gains and accelerated growth may be achieved through enhanced market and regional coverage, improved sales channels, and deeper customer relationships. Filling gaps and expanding offerings, enhancing technical and application capabilities, and adding high-value IP to the portfolio all enable the buyer to become a more strategic partner with customers.

While the buyer will not pay for all these synergies, they will pay some associated premium and retain the remaining post-close value. This accounts for risk and downsides to assure an adequate return on their efforts and investment. The buyer will estimate the EBITDA multiple both before and after estimated synergies to make sure the acquisition makes sense for their company at that price.

Capturing More Value

Numerous additional actions that can also drive value and put more money in your company’s pocket generally fall into a few buckets:

- Improve pre-sale EBITDA

- Pay down debt

- Identify post-close EBITDA improvement opportunities for the buyer

- Reduce perceived risk in portfolio and growth pipeline

Sellers typically only get paid on “real” EBITDA and gains (i.e., those that have been implemented and shown to achieve the targeted result). Anything short of this standard will be discounted to some extent or not valued at all in the buyer’s offer. The buyer may consider these as upside in their synergies.

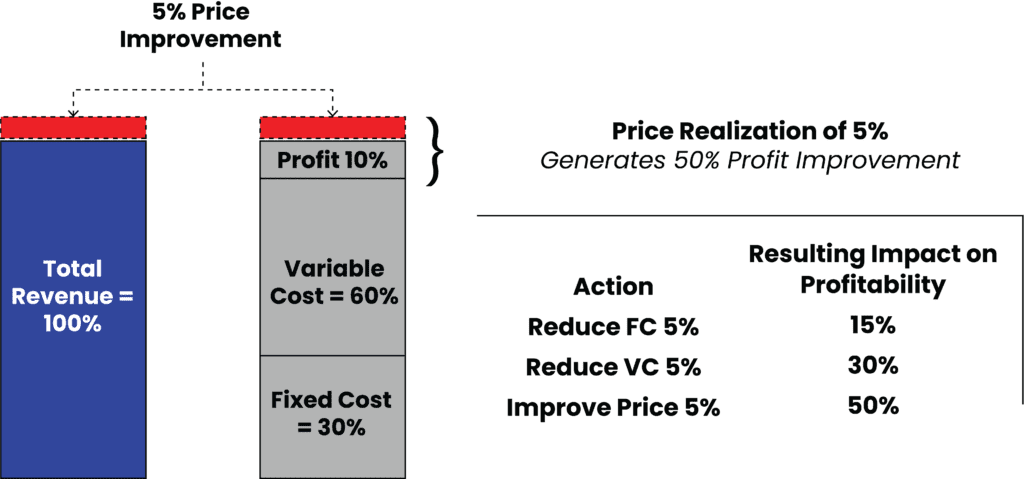

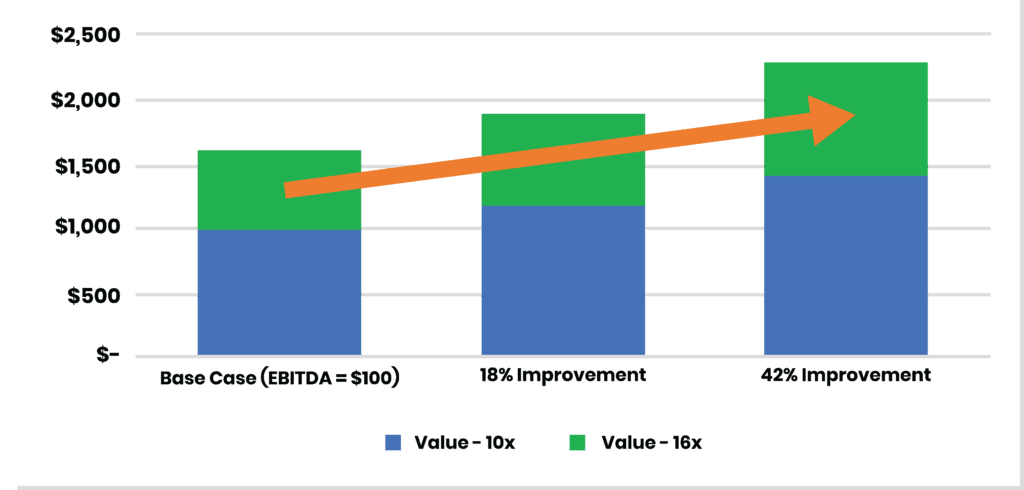

Every dollar of EBITDA improvement typically nets $10-16 more on sales price (Figure 2). While reducing debt does not enjoy the same multiple, it does reduce the amount of proceeds you pay to your lender and allows you to keep more in your company’s pocket.

It seems logical that sellers would place a high priority on pre-sale operational improvements, but this is not always the case. Why? The answer often lies in time, effort, resources, and bandwidth constraints. Luckily, all of these can be addressed with adequate time and resources in the preparation phase.

A third-party independent advisor equipped to provide assistance in the form of a comprehensive analysis across sales, R&D, manufacturing, and purchasing often uncovers hidden EBITDA. You then have an opportunity to capture profit leaks through pricing actions, while improvements in efficiency lead to reduced waste and improved variable cost. Focusing on strategies that deliver higher returns on investment more quickly improves the productivity of your organization’s valuable resources and makes the company more attractive to future buyers.

In practice, sellers we have worked with have been able to boost EBITDA from 18-42%, netting them up to double the net proceeds (Figure 3). While the process to identify and capitalize on these potential EBITDA improvements can be lengthy, some of the enhancements may be completed more quickly and lend credibility to the seller’s pipeline.

It is also important to validate the value of your company’s commercial portfolio. This includes demonstrating the “stickiness” of the existing business (driving confidence in base business retention), while an assessment of market dynamics will impact the value of the company’s innovation pipeline to drive growth. Both of these issues will be subject to focused and repeated questioning during management presentations and diligence.

Extra steps taken during the preparation step address these critical value determinants. External market assessments, voice of customer, and market and technology trends address both the stickiness and growth potential of your business, demonstrating how the company is positioned to take advantage of market conditions and trends while uncovering opportunities and threats.

Innovation pipelines are discounted to a varying extent due to commercial and technical risks. To be valued by the buyer and reflected in the offer price, your opportunity pipeline must show clear links to market trends, what need will be met, why the solution will be successful over other options, and why your enterprise will win over others in the marketplace.

Lay the Groundwork for Success

When selling your business, do not shortcut key preparation steps. Clear benefits result when sellers drive significant added value with operational improvements prior to the sale. Successful sellers demonstrate the value of the business to future buyers, creating confidence in the company’s potential for future growth and painting a vision to achieve meaningful synergies.

Time is money, and your people are a great asset. Astute sellers use a team of third-party experts as an extension of their team to expand the bandwidth needed to add the most value and drive success. The additional preparation and information gained demonstrate the competence and professionalism of your team to buyers as they consider how they will retain and grow the post-close value and run the business in the future.

Sell-Side M&A: Best Practices in Preparation

- Engage an M&A advisor and consultant at least a year before putting a business on the market.

- Identify and quantify likely synergies of potential buyers; create an investment thesis for each.

- Conduct in-depth assessments of the market size, structure, competition, shares, technologies, and trends (i.e., why your business projections make sense).

- Demonstrate business “stickiness” through voice of customer.

- Conduct external assessments and demonstrate track record to assess IP and potential growth opportunities in the pipeline.

- Identify profit leaks and address opportunities to improve EBITDA—in operations, pricing, and product portfolio.

- Identify and address operational, environmental health and safety (EHS), and commercial risks.

To learn more, reach out to the author at jvaughnbiege@chemquest.com.

Read in Chemistry Today.

References and notes

*The Pugh Matrix is a criteria-based decision matrix that uses criteria scoring to determine which of several potential solutions or alternatives should be selected. The technique gets its name from Stuart Pugh and has become a standard part of Six Sigma methodology. Typically used after the development of the VOC (Voice of the Customer) and after the creation of a QFD (Quality Function Design), it allows for the organization of various criteria (or features) of a solution in a structured way for easy comparison.