Table of Contents

Have you seen those TV shows about people trying to get the most value when selling their home? The home seller typically hasn’t gotten any nibbles at the price they think they deserve, so they turn to professionals.

Some of the experts stage the home and focus on improving curb appeal to drive needed traffic into the home. While this approach often leads to a sale, it may not net the seller the highest purchase price. Other experts perform an assessment of the local market to uncover what those target buyers want, and they remodel the home accordingly. Not only does this approach often identify the ideal buyer, but it also frequently creates additional value for the seller.

Similar concepts apply when selling a company or business unit, whether in the specialty chemicals space or not. Sellers that shortcut preparation steps before putting the business up for sale often leave money on the table.

Preparation is Key

The main goal of selling a specialty chemicals business remains the same as selling a home—obtain the most value and find the right buyer. In some cases, the terms of the sale may be as important as price. Potential integration scenarios, the ability to successfully close the deal as agreed, and completion of regulatory hurdles such as antitrust and Committee on Foreign Investment in the United States (CFIUS) requirements are equally critical. These factors can torpedo a sale after a great deal of investment in time and money.

It is important to allow sufficient time to prepare the business for sale well before active marketing begins. Preparation includes identifying potential buyers, studying and characterizing the market and the company’s position in it, and developing the value proposition considering the target buyer pool. Sellers should allow 12 months or more to analyze and capture profit leaks.

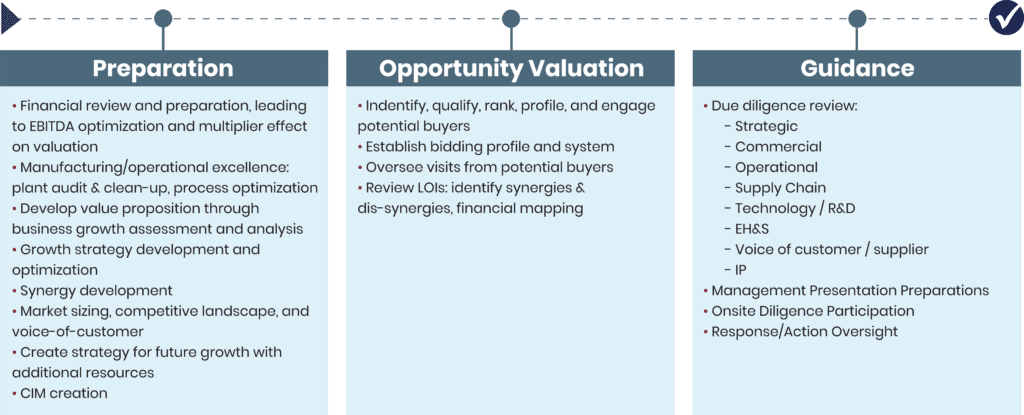

First steps include interviewing and selecting a team of experts (e.g., consultants, bankers, and advisors) that will have a role in coordinating all aspects of the sale and marketing materials. While a heavy lift alone, these experts help with key preparation activities (Figure 1).

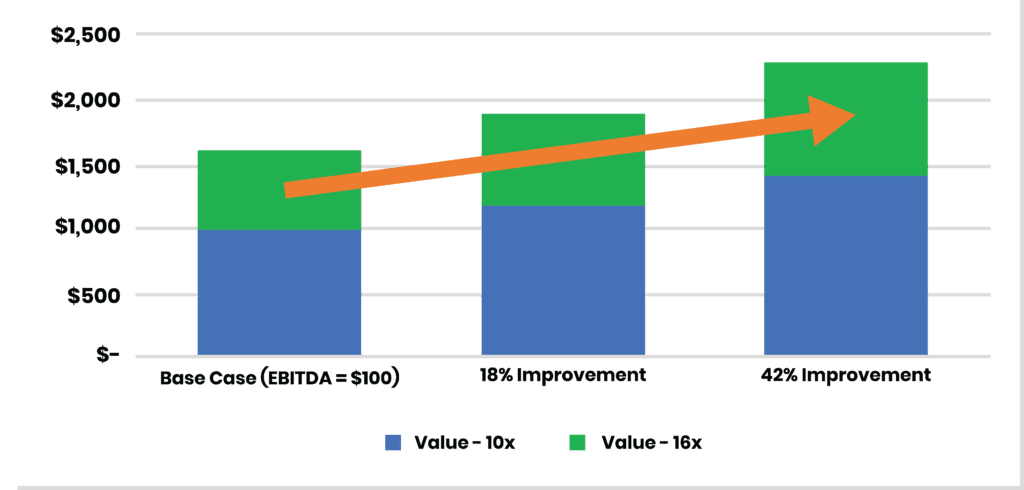

Company ownership and management often have their own concept of the business’ value, based on earnings before interest, taxes, depreciation, and amortization (EBITDA) times the expected multiple. Based on size, industry, quality of earnings, growth, and current economic/market factors, multiples range from an average of 10.5x for a specialty chemical manufacturer to 16x for consumer packaged goods (CPG) companies.

However, the average is just that—an average. Buyers may pass at making an offer at all if the seller’s business requires excessive time and money in maintenance or integration efforts and/or lacks a compelling strategic alignment. Buyers will adjust their offer based on their assessment of the strength of the investment thesis, projected synergies, and the extent to which the purchase enables them to meaningfully achieve their strategic goals.

Synergy, Synergy, Synergy

Synergies relate to the expected improvement in financial performance of the post-close combined enterprise compared to the financial results and projections of the existing base business. They play an integral role in how much a buyer is willing to pay over the standard multiple.

A key part of preparation is considering the who and establishing the why for each potential buyer. It is important to be thorough and quantitative about the unique synergies that will drive interest in the seller’s business and impact how much each buyer might pay to acquire it.

A thorough understanding of the different players and their strategies is important to cast a targeted net and tailor the communications accordingly. Obvious choices for potential strategic buyers include: direct competitors; companies looking to diversify or strengthen their portfolio or technology platforms in specific markets; companies looking to expand their geographic reach or manufacturing footprint or acquire enabling capabilities and platforms; and companies seeking to forward- or back-integrate.

Financial buyers represent another significant and attractive buyer pool. Private equity (PE) buyers historically have been known to pay lower prices (multiples) to the seller. However, as PE firms have built platforms based on multiple acquisitions, they are able to achieve and pay for synergies. Financial leverage can make the return on invested capital attractive to this type of buyer. PE firms can also bring additional resources to bear to further business growth, and they offer the increased autonomy of being private vs. public.

The most common marketing materials for the seller’s business—the teaser and the confidential information memorandum (CIM)—do not highlight the synergies for a specific buyer. The teaser is a short document that provides an overview of the business without revealing the identity of the seller, while the CIM is a comprehensive “book” about the business, its finances, and assets.

Since each buyer must determine the benefits, synergies, and value for themselves, best practices for sellers often include developing a rationale for acquiring the business tailored to each buyer. Advisors may use these key points to highlight potential value to buyers; serious buyers also engage advisors to independently validate value.

In evaluating synergies, it is important to consider cost savings, sales gains, and accelerated growth rates. Cost savings may include raw material and service savings from increased purchasing power, higher value use of intermediates/byproducts, process/efficiency improvements from shared intellectual property (IP), and streamlining and/or consolidating operations and services. Revenue gains and accelerated growth may be achieved through enhanced market and regional coverage, improved sales channels, and deeper customer relationships. Filling gaps and expanding offerings, enhancing technical and application capabilities, and adding high-value IP to the portfolio all enable the buyer to become a more strategic partner with customers.

While the buyer will not pay for all these synergies, they will pay some associated premium and hold on to the remaining post-close value. This accounts for risk and downsides to assure an adequate return on their efforts and investment. The buyer will estimate the EBITDA multiple both before and after estimated synergies to make sure the acquisition makes sense for their company at that price.

Capturing More Value

In addition to understanding potential buyers and creating investment thesis possibilities, numerous additional actions can drive value and put more money in a seller’s pocket. These generally fall into a few buckets:

- Improve pre-sale EBITDA

- Pay down debt

- Identify post-close EBITDA improvement opportunities for the buyer

- Reduce perceived risk in portfolio and growth pipeline

The seller will typically only get paid on “real” EBITDA and gains (i.e., those that have been implemented and shown to achieve the targeted result). Anything short of this standard will be discounted to some extent or not valued at all in the buyer’s offer. The buyer may consider these as upside in their synergies.

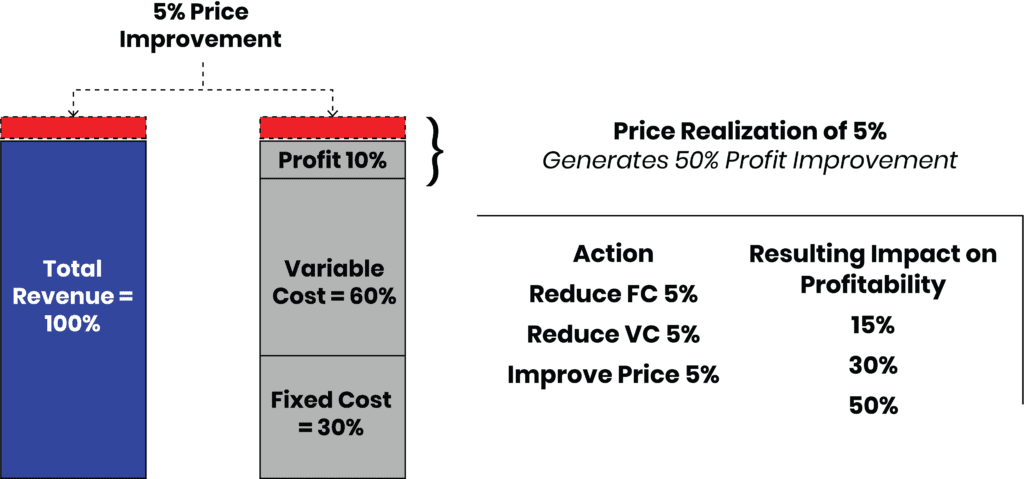

The first two items increase the net sale proceeds significantly; every dollar of EBITDA improvement typically nets $10-16 more on sales price. Reducing debt does not enjoy the same multiple, but it does reduce the amount of proceeds sellers pay to their lenders and allows sellers to keep more in their pocket.

Why then would a seller not place a high priority on pre-sale operational improvements? The answer often lies in constraints related to time, effort, resources, and bandwidth—all of which can be addressed with adequate preparation.

Assistance from a third-party independent advisor in the form of a comprehensive analysis across sales, R&D, manufacturing, and purchasing often uncovers hidden EBITDA. Sellers then have an opportunity to capture profit leaks through pricing actions, while improvements in efficiency lead to reduced waste and improved variable cost. Focusing on strategies that deliver higher returns on investment more quickly improves the productivity of the organization’s valuable resources and makes the company more attractive to future buyers.

In practice, sellers we have worked with have been able to boost EBITDA from 18-42%, netting them up to double the net proceeds (Figure 3). While the process to identify and capitalize on these potential EBITDA improvements can be lengthy, some of the enhancements may be completed more quickly and lend credibility to a seller’s pipeline.

Validating the value of a seller’s commercial portfolio is also important. This includes demonstrating the “stickiness” of the existing business, which drives confidence in base business retention. An assessment of market dynamics impacts the value of the company’s innovation pipeline to drive growth. Both will be subject to focused and repeated questioning during management presentations and diligence.

Extra steps taken during the preparation step address these critical value determinants. External market assessments, voice of customer, and market and technology trends address both the stickiness and growth potential of the seller’s business. These factors demonstrate how the company is positioned to take advantage of market conditions and trends while uncovering opportunities and threats.

Innovation pipelines are discounted to a varying extent due to commercial and technical risks. To be valued by the buyer and reflected in the offer price, a detailed opportunity pipeline must show clear links to market trends, what need will be met, why the solution will be successful over other options, and why the seller’s enterprise will win over others in the marketplace.

Lay the Groundwork for Success

Sellers should not shortcut key preparation steps. Clear benefits result when sellers drive significant added value with operational improvements prior to sale. Successful sellers demonstrate the value of the business to future buyers, creating confidence in the company’s potential for future growth and painting a vision to achieve meaningful synergies.

An organization’s people are a great asset, and time is money. Astute sellers use a team of third-party experts as an extension of their team to expand the bandwidth needed to add the most value and drive success. The additional preparation and information gained demonstrate the competence and professionalism of the seller’s team to buyers as they consider how they will retain and grow the post-close value and run the business in the future.

To learn more, contact the author at (330) 631-1429 or jvaughnbiege@chemquest.com.

Read the article in HAPPI.